Credit Cardholders: A Seismic Shift in the User Landscape - Cross Tabs

- Date:December 14, 2010

- Author(s):

- Ken Paterson

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Credit Cardholders: A Seismic Shift in the User Landscape

Third of eight reports from Mercator Advisory Group's CustomerMonitor Survey Series probes consumer outlook and usage of credit cards

Boston, MA -- Based on numerous spending data, it's clear that U.S. consumers have become credit conscious, steering away from the use of general purpose credit cards. Today, many consumers are electing to use other payment types, even hard cash, for the purchase of goods and services. What's not as transparent is whether or not consumers are conditioning themselves and modifying their behaviors indefinitely or just until the economy recovers.

The third in a series of eight topical consumer survey reports examining payment and banking topics, Mercator Advisory Group's Credit Cardholders: A Seismic Shift In the User Landscape report provides a unique view to current consumer credit card behavior including patterns of credit card ownership, usage, attitudes toward future card use, awareness of the CARD Act, and participation in credit card rewards programs.

The Credit Cardholders: A Seismic Shift In the User Landscape report is based on a national sample of 1,009 online consumer survey responses completed between May 10-14.

Highlights of this report include:

General purpose credit card ownership by households dropped significantly between Mercator's 2009 and 2010 surveys, a drop corroborated by external sources. Reported private label card ownership also dropped. The speed of these declines - about 12 months - is particularly notable.

GP credit card ownership declines were broad across income groups, and interestingly among middle age and older consumers, people usually considered in their peak earning and spending years.

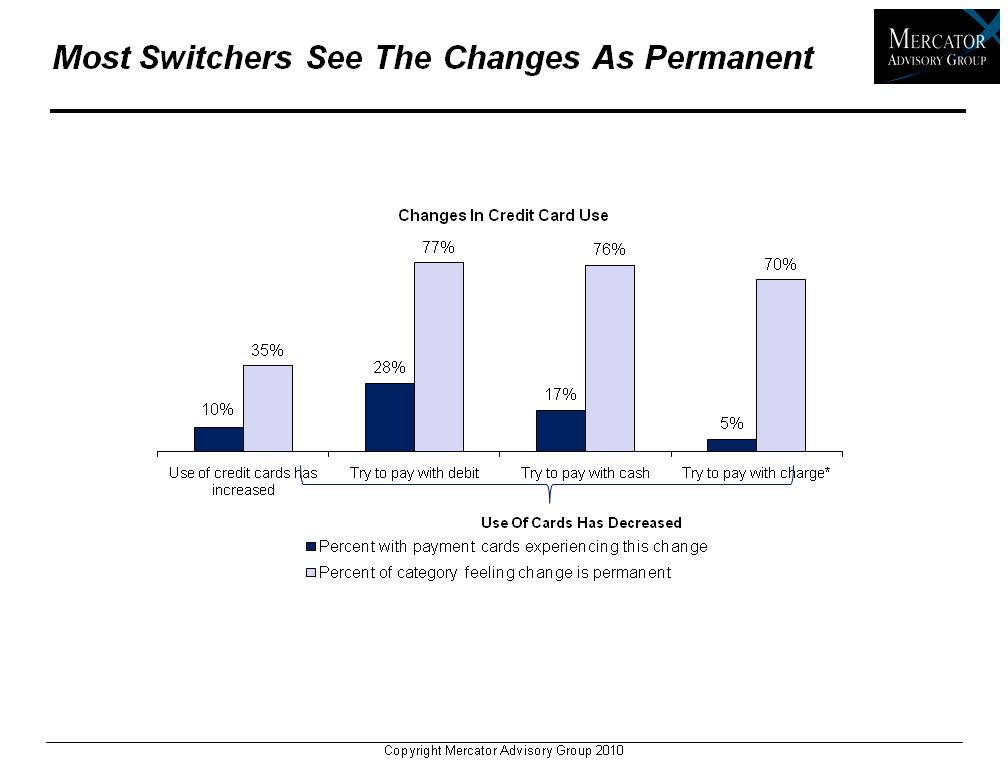

Many payment card users say they are trying to reduce interest-accruing credit card balances, and many report they are succeeding. As in the 2009 survey, most express the opinion that these changes are permanent.

Just over half of all consumers indicated they had heard of the CARD Act. For a credit card price-conscious segment that is aware of the CARD Act, there is a correlation with decreased card usage.

"In last year's survey, we stepped into a beehive of consumer pessimism and frankly aversion to credit card use. We were surprised by the extent and depth of anti-credit card sentiment, and noted that such sentiments could be fleeting and that consumer behavior could be inconsistent with sentiments in the long run. One year later the landscape has changed dramatically. Fewer people are now saying they are turning away from credit, in large part because so many have already turned away," states Ken Paterson, VP for Research Operations at Mercator Advisory Group and the author of the report.

One of the 14 exhibits included in this report.

The report is 34 pages long and contains 14 exhibits.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

2024 North American PaymentsInsights: Canada: Generational Consumer Payment Trends

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

2024 North American PaymentsInsights: U.S.: Generational Consumer Payment Trends

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

2024 North American PaymentsInsights: Canada: Exhibit

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

Make informed decisions in a digital financial world