Overview

Boston, MA

July 2004

Credit Cards in Japan

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

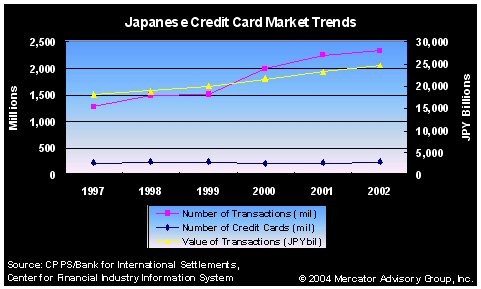

In 2002, Japanese consumers purchased JPY 24.7 trillion (USD 198 Billion) worth of goods and services resulting in 2,339 million credit card transactions. There were nearly 245 million credit cards in circulation in the same year; making Japan one of the world's largest credit card markets.

The credit card industry has gone through a busy M&A period recently, UFJ Bank acquired Nippon Shinpan and the merged credit card business created Japan's second largest issuer with over 23 million cardholders. Meanwhile, Mizuho Holdings took management control of Orient Corp.

In April of 2004, Japan lifted the ban on banks, which prohibited them from directly offering credit cards. While this gives Japanese banks the opportunity to offer a more complete product mix and target the consumer segment more effectively (where they have been less penetrated historically), it also requires banks to tackle the issue of bad loans before starting to lend more aggressively through credit products.

Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service comments, "In addition to the mergers and acquisitions, there is an increasing number of partnerships happening in the industry. These partnerships aim to improve operational effectiveness as well create access to different market segments."

This report contains 20 pages and 14 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to info@mercatoradvisorygroup.com.

Learn More About This Report & Javelin

Related content

2025 Credit Payments Trends

In 2025, credit card issuers are not just facing change; they are at the forefront of shaping the future of the consumer credit industry. Despite the weakening consumer economics, ...

2024 Mass-Market Credit Cards Scorecard

Mass-market credit cards must balance features and rates to attract average U.S. consumers. This Javelin Strategy & Research report benchmarks general-purpose credit cards by 10 ma...

Market-Driven, Risk-Based Credit Card Pricing Works: Price Controls Would Disrupt Borrowing and Lending

A 10% cap on credit card interest rates—an idea floated in the presidential race—would have profound effects on the credit card market, cutting deeply into how credit cards are pri...

Make informed decisions in a digital financial world