Overview

Boston, MA

April 2004

Credit Opportunities in China

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

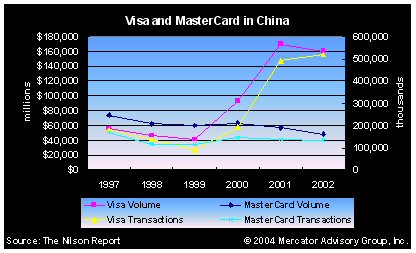

With a population exceeding 1.2 billion and a 2003 GDP of $1.414 trillion, China is one of the world's largest economies and an attractive market for global credit card companies seeking new growth opportunities. As the Chinese government continues to improve the country's financial system in an effort to implement its WTO commitments, global credit card issuers are increasing their efforts, becoming early movers in the green field Chinese credit card market.

The People's Bank of China and China Banking Regulatory Commission approved American Express, Citibank and HSBC to issue credit cards with their local partners in China. American International Group, Morgan Stanley, and ABN Amro are waiting for licenses or have announced intentions to issue credit cards in the region. Morgan Stanley is looking to launch the Discover Card in China. ABN Amro has partnered with MasterCard to issue cards in China. MBNA recently announced the opening of a representative office in Shanghai.

Despite these developments however, there are many challenges to overcome in order to build a viable credit card market in China. Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service comments, "the metrics related to credit cards suggest that the market is in its infancy and can only grow from here. However, there are issues such as the availability of credit information, the task of connecting separate bankcard networks, merchant enablement, and increasing the number of cards issued, which will need to be resolved for strong credit market development in China."

A new Mercator Advisory Group report examines the Chinese credit card market and its challenges by examing the historical development of the bankcard market from 1978, when China initiated the change in its economic policy, to today. The report: provides discussion on initiatives such as the "Golden Card Project"; looks at market growth trends; examines industry players including local and foreign issuers, processors, associations and credit bureaus; and, discusses regulations and credit information availability.

This report contains 25 pages and 14 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world