Overview

Boston, MA

December 2008

Cross Border Payments: U.S. Banks Imperiled by Lagging Deployment of Real Time Gross Settlement Systems

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

In 2006, $2.5 trillion dollars in foreign exchange, cross border payments were settled each day. While cross-border payments will continue to grow in both dollar volumes and number of transactions, their foreseeable growth rate, tracking overall global economic trends, will dramatically slow.

This report from Mercator Advisory Group's Corporate Banking Practice examines the global payments landscape focusing on the emerging Real-time Gross Settlement Systems poised to gain universal standards adoption. That standardization is the platform bedrock allowing cross-border payments systems to seamlessly work together, reducing risk for the multiple payments stakeholders in global trade.

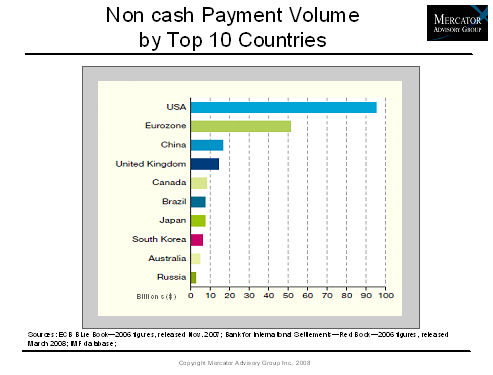

Emerging real time gross settlement systems are being adopted across the European Union and by the central banks of emerging market powerhouses. Unfortunately, the U.S. banks, held captive by their legacy payments systems, have forfeited their leadership role in the facilitation of cross-border payments. While the United States remains the world's leading importer and exporter of goods and services, its commercial banks for losing market share and millions of dollars of revenues as settlement responsibilities migrate to the leading banks of other nations.

One of the 16 Exhibits included in this report

This report is 39 pages long and contains 16 exhibits.

| Industry Segmentation: Identifying High Value Niche Opportunities | |||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Learn More About This Report & Javelin

Make informed decisions in a digital financial world