Overview

Boston, MA

November 2008

Declining Credit Card Growth 2008: A (Leaking) Glass Half Full

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

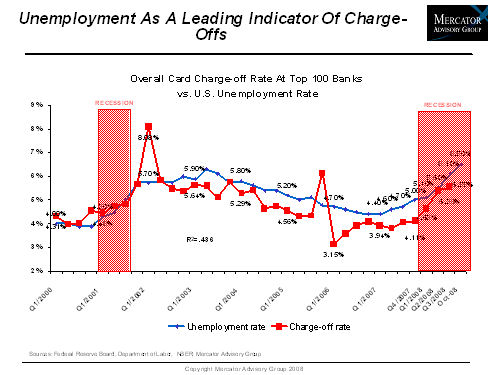

This report provides a state-of-the-industry commentary based on the critical economic events unfolding in 2008. Mercator's last review of this topic in 2006 characterized the credit card environment as "A Glass Half Full", thanks to an array of growth opportunities still available to issuers, as well as generally stable economic conditions. This report updates broad industry indicators and discusses potential outcomes within today's tumultuous economic environment. Topics explored include:

- Credit card issuers remained profitable through 2007, but card receivables and volume growth continued their general slowing.

- Card receivables growth has continued even into Q3/08, although a flattening of growth is apparent.

- Q4/08 could be an inflection point in consumer card borrowing; the U.K. offers one example where consumers led the decline.

- Issuers are deploying their recessionary credit management tools. The big unknown is how issuers will deal with a new external challenge: the loan funding crunch.

- Two extreme scenarios are suggested for 2009: one where the Fed's TALF facility helps issuers maintain funding, and an alternative where a perfect storm of converging events re-shapes the card industry.

Ken Paterson, Director of Mercator Advisory Group's Credit Advisory Service and the author of this report, comments, "Some of the most threatening possibilities for the credit card industry reflect potentialities it has never before experienced. So on one hand, the credit card industry has proven time and again that it can manage risk - especially the consumer variety - and live to grow another day. On the other hand, risks external to the business are posing new threats that are only beginning to register."

One of the 14 Figures included in this report

This report contains 27 pages and 14 exhibits.

Other recent reports from the Mercator Credit Advisory Service:

| Merchant Acquiring in the United States 2008: Birth of the Perfect Storm? | ||||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world