Overview

Mercator Advisory Group’s new report Decoupled Debit: The Start of Mainstream Adoption? provides an understanding of the current decoupled debit market in the U.S. and how it works, why the current payment industry environment may foster more decoupled debit programs, indicators that decoupled debit may be gaining popularity and thus threatening bank-based debit, and the revised Payment Services Directive (PSD2) in the European Union.

“Decoupled debit is a payments product to watch for future development and growth. It offers merchants most of the benefits they seek in a payment—namely, independence from the card networks, less expensive transaction processing costs, a platform to extend rewards, and less fraud than traditional card transactions,” commented Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report has 14 pages and 3 exhibits.

Companies mentioned in this report include: First Data, MasterCard, Target, VocaLink, and ZipLine.

One of the exhibits included in this report:

- Current market sizing

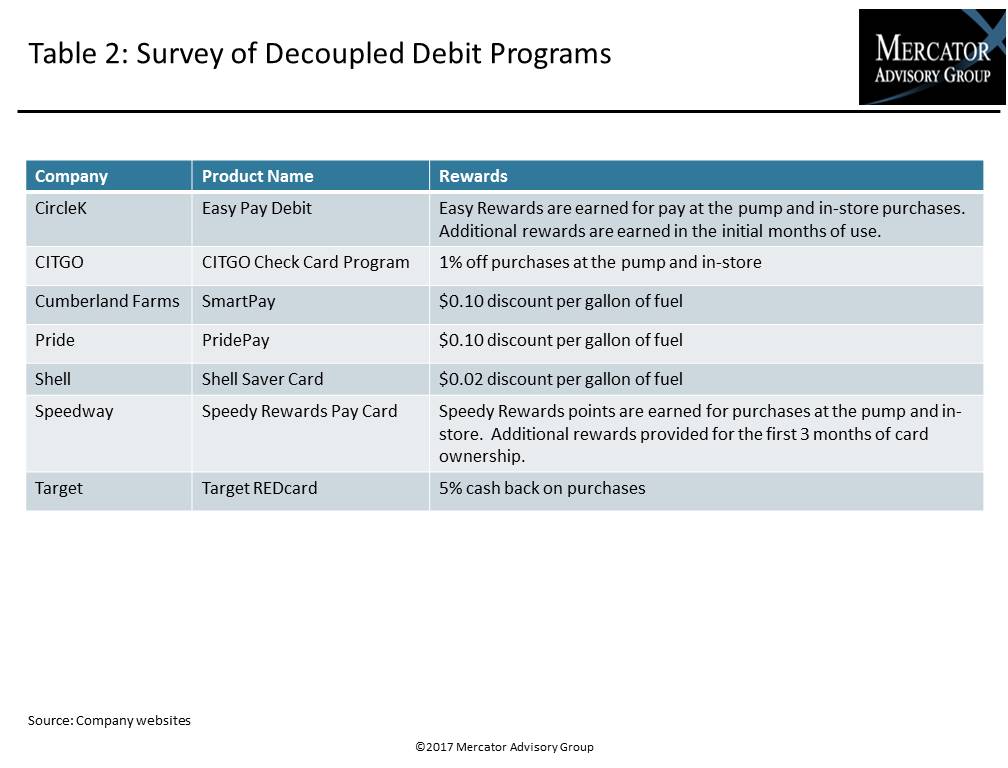

- A look at current decoupled programs

- Decoupled debit in the European Union

- Product challenges

- Market forces that are providing growth opportunities

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world