Deepening Customer Relationships with Small Business Banking

- Date:October 06, 2014

- Author(s):

- Ed O'Brien

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In this research note, Deepening Customer Relationships with Small Business Banking, Mercator Advisory Group reviews why and how financial institutions are expanding their outreach to this important customer base.

“With today’s banks and credit unions striving to find new ways to increase revenues and boost profitability, the topic of small business banking is increasingly top of mind for these financial institutions,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

This research note is 9 pages long and has 4 exhibits.

Members of Mercator Advisory Group Banking Channels Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

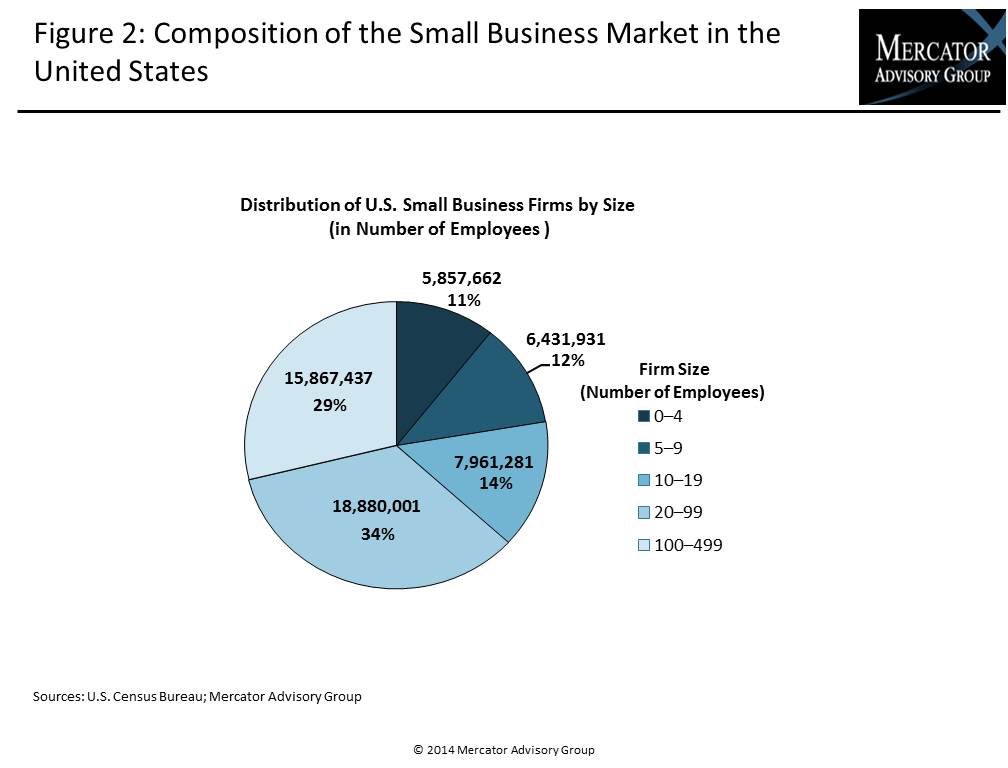

One of the exhibits included in this report:

Highlights of this report include:

- Market size and composition, suggesting the important role that small business customers can play in the financial institution’s revenue mix and their contribution to overall profitability

- The potential lift that small business banking can provide as FIs seek additional revenue sources to offset losses in fee income from their retail banking operations

- Common value-added banking products and services that can fill the wide variety of needs of small business banking customers and become revenue streams and opportunities for greater engagement

- Recommendations for ways to serve this market and deepen customer relationships

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world