Overview

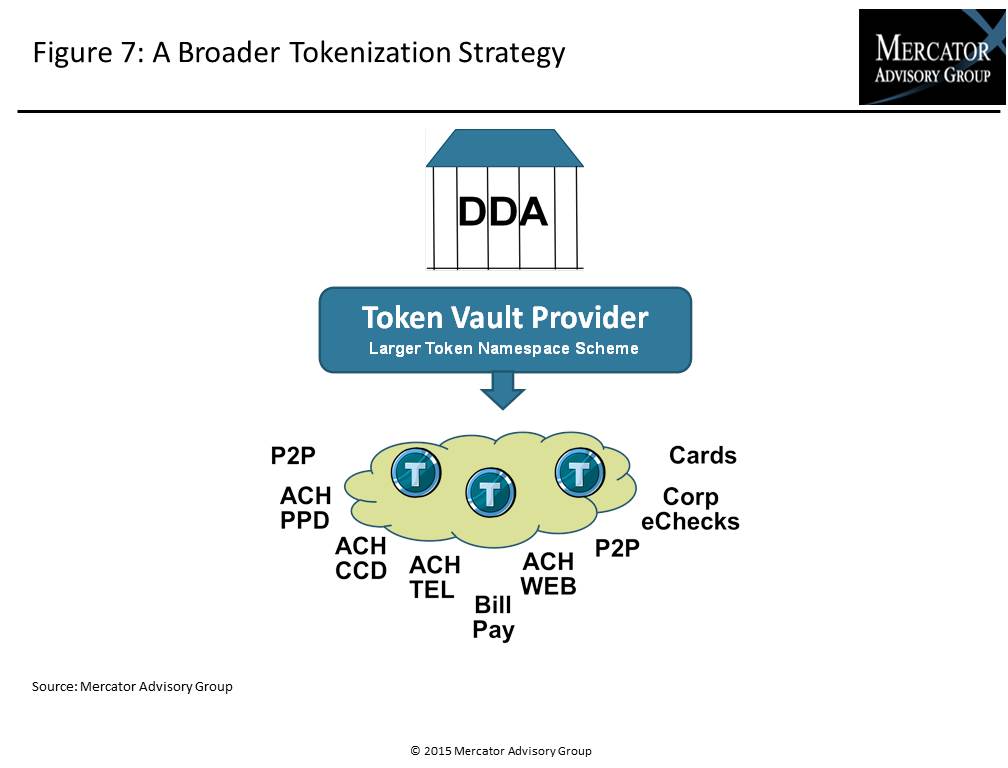

While banking institutions and other organizations are anxious to provide mobile payment capabilities to their most profitable customers, it is imperative they find the right strategic path in a difficult and highly complex mobile payment marketplace that is being targeted by multiple industries and large corporations within those industries. In particular, financial institutions must recognize that tokenization will span more than just card networks. The institution must consider a tokenization strategy that will protect the consumer’s account number, not just the PAN, for all external communications, which includes person-to-person (P2P) payments, bill pay, ACH, and all other external interactions.

“The need for the protection implemented by tokenization far exceeds the reach of any single payment implementation, so financial institutions should consider this strategy that incorporates various payment mechanisms and suppliers under a broader tokenization scheme,” comments Tim Sloane, VP, Payments Innovation, and author of report.

This report is 30 pages long and contains 8 exhibits.

Companies mentioned in this report include: American Express, Apple, AT&T, Chase, China UnionPay, Discover, EMVCo, FIS, Google, JCB, MasterCard, NACHA, Paydiant, PayPal, Samsung, Softcard, T-Mobile, Verizon, Visa, and Wells Fargo.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

- Data documenting U.S. consumer attitudes toward mobile payments and predicting volumes for mobile commerce

- Documentation for the drawbacks and gaps associated with the current payment solutions offered by Apple and the nationally branded networks

- Illustrated explanation of how various token-based mobile payments schemes work

- Questions for financial institutions to ask when evaluating mobile payment solutions

- Description of a broader tokenization scheme and identification of the payment mechanisms Mercator Advisory Group recommends FIs consider under such a scheme

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world