Overview

Durbin Amendment Final Rules: Analyzing Settling Dust

Report Assesses the Durbin Amendment and Considers the Impact Across Stakeholders and the Future of Payments.

Boston, MA -- Now that the Durbin Amendment (Regulation II) has been moved from possibility to reality, we must put this legislation in context of the current dynamics within and around the payments market.

Mercator's new report, Durbin Amendment Final Rules: Analyzing Settling Dust, takes a wide market view across its primary stakeholders. By incorporating expert analysis alongside findings from executive interviews and conversations, the report presents a picture of the present and, what could be, the future state of the debit card industry.

In the report, Mercator thoughtfully examines major components of the final rules, presents the potential impact each may have on the market, and offers an organizing framework for considering the Amendment's impact on the U.S. debit payments industry moving forward.

"In response to the Durbin Amendment, we believe it is reasonable to assume that the FI market will more rapidly build efficiencies and aggressively compete to gain more financial services activity per consumer," Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service comments.

Highlights of this report include:

A discussion of market dynamics that lead to the Durbin Amendment being signed into law.

Review of the changes taking place in the non-interest revenue streams supporting retail depository accounts in the United States.

A detailed discussion of the major components of the legislation including:

The potential impact on the small/medium sized financial institution market, and why interchange fee regulation may be a small part of a much larger challenge for this group of issuers.

How issuers may react to the surprising new exemption criteria for prepaid card programs.

What the upside is in being designated a regulated payment card network.

The long-term impact of the Durbin Amendment as a catalyst for material change in the current system of interchange fees.

The areas where the Amendment has the potential to start a new round of market constriction, and the providers that would benefit from this shift.

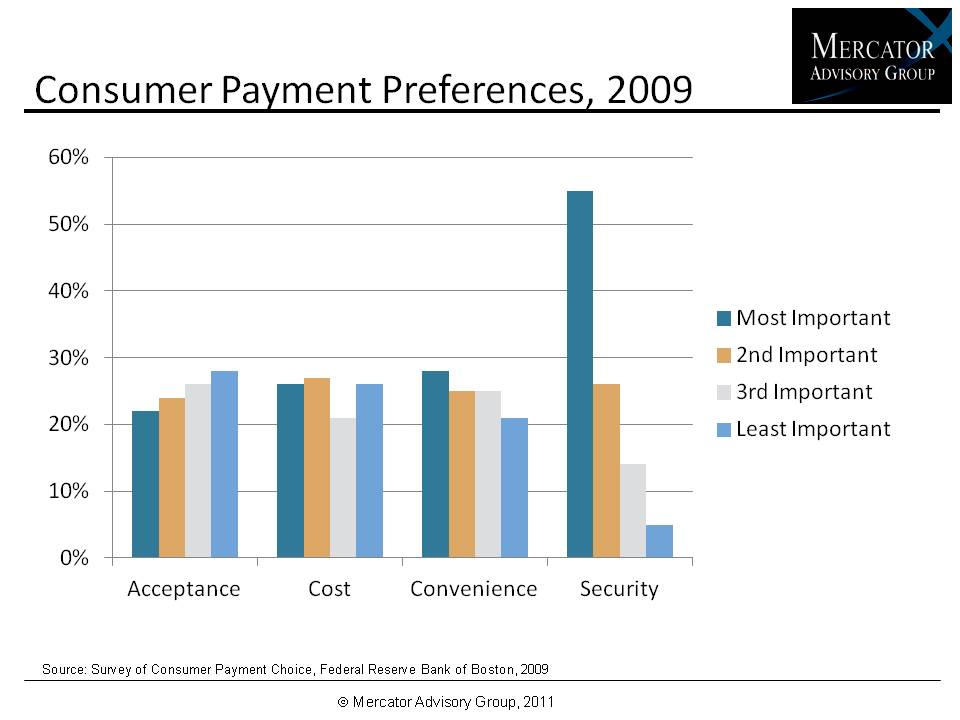

One of 11 exhibits in this report:

This report is 35 pages long and has 11 exhibits.

Companies mentioned in this report include: Federal Reserve Bank, Visa, MasterCard, American Express, PayPal, First Data, PULSE, Shazam, Fiserv, FIS, Citibank, JPMorgan Chase, Wells Fargo, PNC Bank, U.S. Bank, and Discover.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world