Overview

EFT Networks: Next Generation Cycle

Report Examines the Evolution of Major EFT Networks

Forecasts Future State

Boston, MA -- Today's electronic funds transfer industry is rapidly evolving and the recent development of EFT networks, along with a new set of business drivers created by their corporate ownership structure, will converge to reshape the market in coming years. Overlaying this dynamic is the question of the value of PIN vs. signature debit and the interchange fee changes created by Regulation II (Durbin Amendment) which colors any analysis of debit industry stakeholders.

In the new report, EFT Networks: Next Generation Cycle, Mercator Advisory Group analyzes the impact of debit card market dynamics on PIN debit networks. The piece also considers the future state of EFT networks and presents some potential future outcomes.

Highlights of this report include:

The new criteria issuers are using to examine EFT networks that have evolved from non-profit entities to corporate-owned businesses

Examination and findings regarding interchange fee structures for unregulated issuers

Which network stands to lose the most through this transition period and why

The market forces that will bring pressure on the U.S. based-only EFT networks to evolve their systems to address new payment forms issuers are most interested in developing

Rank order of national EFT networks by number of issuers on file

The national network brands that remain in the U.S. market have entered a period of intense pressure to evolve their business model in a market that is demanding the ability to respond to the growing threats against card-based businesses as well as the opportunities present in emerging products.," Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service comments.

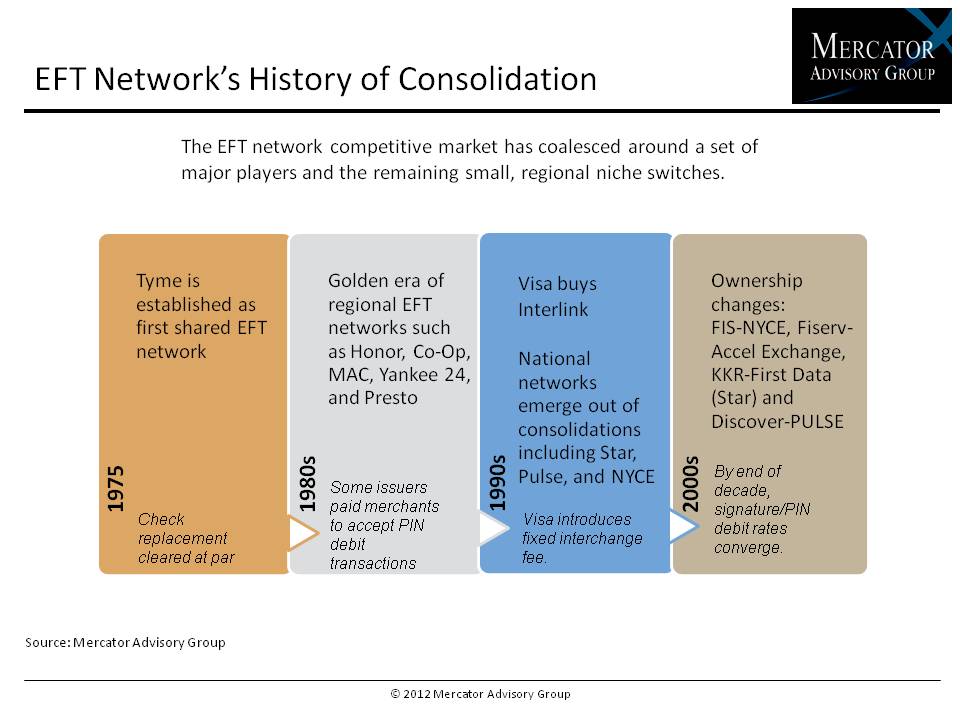

One of 12 exhibits in this report:

This report is 27 pages long and has 12 exhibits.

Companies mentioned in this report include: Fiserv, FIS, First Data, Discover, Visa, MasterCard, Accel Exchange, Shazam, PULSE Network, Star, NYCE, and Maestro.

Members of Mercator Advisory Group's Debit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world