Overview

Electronic Bill Pay and Presentment: Take a Number;

a Consumer Will Be Right with You (Maybe)

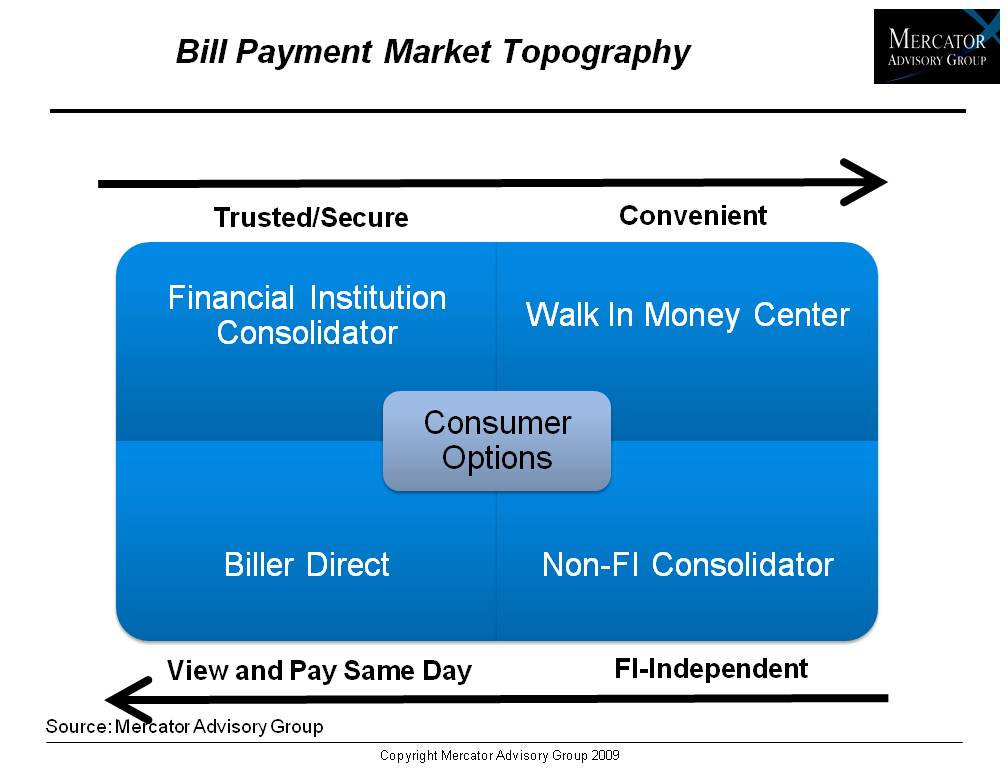

The EBPP market in the United States is striking by the persistent challenge it presents to target a consumer audience whose bill payment preferences regularly shift between services. While financial institution consolidators appear to be making headway, direct billers are holding their own, and in-store money centers are emerging in the market to grab a share of these transactions. Consumer uptake of e-billing is encouraging, but the motivation to standardize the underpinnings doesn't appear to be taking shape in a market where solution providers are actively consolidating.

Historically, the primary EBPP market segments (i.e., FI-consolidators and direct billers) offer services that are rationalized to the consumer under opposing value propositions with one common goal ??? to incent consumers to manage their payments electronically. Our research indicates that this market still has plenty of room to grow and indeed, offers these service providers, particularly the FI-consolidators, the opportunity to elevate the value of their service to the consumer market.

Mercator Advisory Group???s the Electronic Bill Pay and Presentment: Take a Number; A Consumer Will Be Right With You (Maybe) report examines this market from the consumer, financial institution, and direct biller perspectives ??? including a look at how in-store money centers are muscling in on the perennial industry feud between traditional delivery types. We also review the primary solution providers, including new products being launched, and the opportunity for outsourcing in an increasingly complex market.

???In the bill payment industry, as in most of the financial services industry today, the market is actively segmenting itself into distinct solution sets that address the needs of a more granular (and arguably demanding) consumer market than it has in the past. The entry of potentially transformative organizations into the financial services industry, such as Wal-Mart, may serve to siphon off online bill pay users from both direct billers and consolidator sites alike. ,??? Patricia Hewitt, Director of Mercator Advisory Group???s Debit Advisory Service comments.

Highlights of this report include:

EBPP is growing, but the market is by no means a lock for any given service provider.

Consumers continue to choose a variety of bill payment methods making a ???one size fits all??? solution difficult to deliver.

A key component for building market share may be a reframing of the bill payment experience as one component of an online personal financial management (PFM) toolset.

Non-traditional financial services providers, ala WalMart Money Centers, continue to make inroads into the traditional financial institution space.

E-billing appears to be of sustained value to consumers and consolidation of billing service providers may serve to encourage adoption by delivering on economies of scale and ease of implementation.

One of 19 exhibits in this report:

This report is 40 pages long and has 19 exhibits.

Companies mentioned in this report include: Fiserv, Metavante, Yodlee, Jack Henry, Online Resources Corp., iPay, Western Union, Money Gram, WalMart, NACHA.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world