Overview

The Growth of Super Apps Provides Opportunities for Financial Services

Some app providers are extoling the multitude of features their solution offers and have proclaimed that their particular app has achieved “super app” status. Because there aren’t any requirements or a common definition to acquire this title, any app provider can claim this status, and many do. This is the case for ride-hailing, person-to-person (P2P), and financial services apps in the U.S. But these apps are hardly equal to apps found in Asia, such as Alipay, Gojek, and WeChat, that offer a single digital door to mini apps that can be used for nearly every product and service available and can facilitate activity for every facet of life.

This report presents a view of the components of a true super app, outlines the features and functionality of some widely used U.S. apps that claim to be “super,” discusses where the payments industry fits within the ecosystem, and assesses the threats and opportunities that they represent to the financial services industry.

"The topic of super apps has been top of mind for bankers trying to determine the effect that some apps with a broad following could have on traditional financial services providers’ ability to attract and retain consumer customers and members. Recently, several app providers proclaiming their solution to be “super” have signaled increased focus on their app capabilities," comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 21 pages and 6 exhibits.

Companies mentioned in this report include: Affirm, Alibaba, Amazon, American Express, Apple, Block, Capital One, Consumer Financial Protection Bureau (CFPB), Even, FDIC, Fiserv, Gojek, Goldman Sachs, Google, J.P. Morgan Chase, Mastercard, Meta, One, Paypal, Ribbit Capital, Synchrony Bank, Tencent, Tidal, Visa, Walmart, Whole Foods.

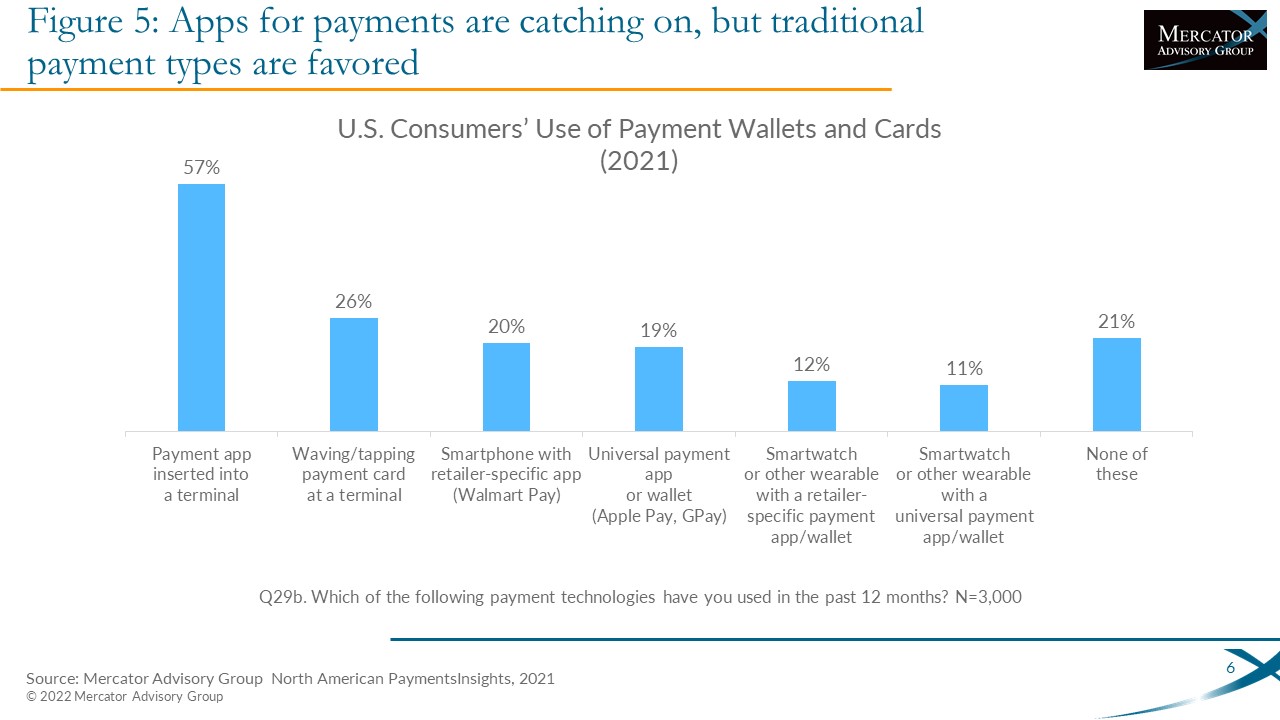

One of the exhibits included in this report:

The Emerging Age of the Super App

Highlights of the report include:

- What Is and What Isn’t a Super App

- Examining U.S. Contenders

- Why Asia-Style Apps Don’t Exist in the U.S.

- What Will Spark or Depress the Development in the U.S.

- Developing a Single, Universal, and Unifying UX

- Why Financial Institutions Should Care About the Development of Super Apps

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world