Overview

Significant progress in the issuance of chip credit cards and the education of consumers has been offset by continued challenges in certifying and activating merchants’ dormant point-of-sale terminals to accept EMV transactions. The resulting blowback—lawsuits, product changes, and policy shifts—has come to define the U.S. EMV migration in 2016.

Mercator Advisory Group's newest research report, EMV in 2016: Breaking Through the Bottleneck, provides an updated outlook on the U.S. EMV migration, including estimates for the issuance of chip credit cards and the distribution and activation of chip-accepting point-of-sale (POS) terminals.

“Consumers have grown much more comfortable with chip cards over the last 12 months,” comments Alex Johnson, Director of Mercator Advisory Group’s Credit Advisory Service and author of the report. “This has thrown the ongoing challenges in activating merchant POS terminals into sharper relief. How merchants, acquirers, and the card networks resolve these challenges will shape the next 12 months of the U.S. EMV migration.”

This report contains 22 pages and 7 exhibits.

Companies mentioned in this report include: American Express, Citi, Costco, Discover, Home Depot, Kroger, MasterCard, Target, Visa, Walmart

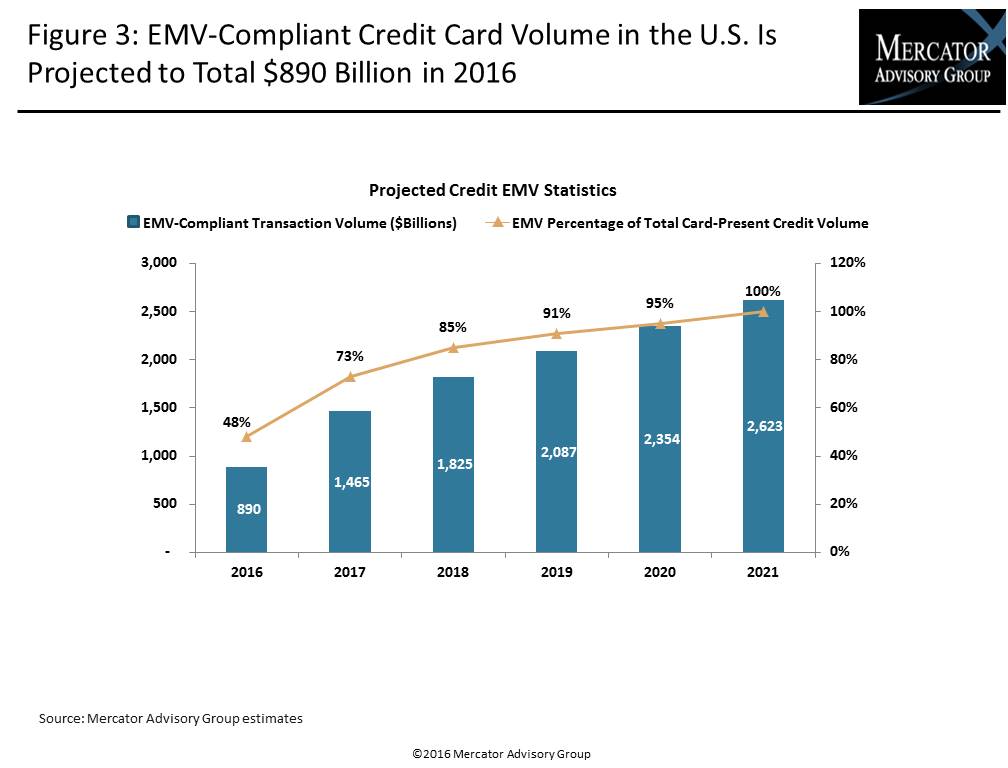

One of the exhibits included in this report:

Highlights of the report include:

- Projections for the issuance of EMV credit cards and the distribution and activation of EMV-capable POS terminals

- Estimates for the volume of EMV-compliant credit card payments in the U.S. over the next five years

- A glimpse into Mercator Advisory Group’s latest proprietary consumer and small business survey results relating to EMV

- An exploration of the issues inhibiting the certification and activation of EMV-capable POS terminals and an overview of the changes announced by the card networks to address those issues

- A review of the policy shifts, product changes, and legal maneuvers that have been employed by merchants and the card networks to resolve key disagreements in the U.S. EMV migration

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world