Overview

Mercator Advisory Group’s latest research report, EMV Technology Update: EMV Classic, Faster EMV, and Now QR Code EMV, goes into detail on how these technologies work, and what card issuers need to do to ensure that EMV QR codes meet a friendlier reception than other network-backed standards.

“EMV got off to an extremely rough start in the United States,” comments Tim Sloane, Vice President, Payments Innovation, at Mercator Advisory Group, author of the report. “While the networks were able to improve the EMV experience by streamlining the process flow, a considerable amount of ill will built up, endangering the reception of a technology that normally merchants would welcome, since it greatly resembles the technology they themselves have adopted. Concentrating on the major pain point of e-commerce fraud would help give EMV QR Code the best chance of success, along with applicability in countries where the point-of-sale infrastructure is underdeveloped relative to the availability of mobile phones.”

This document contains 15 pages and 4 exhibits.

Companies mentioned in this research report include: American Express, Apple, Discover, Google (Android), Mastercard, NYCE, Pulse Star, Starbucks, and Visa.

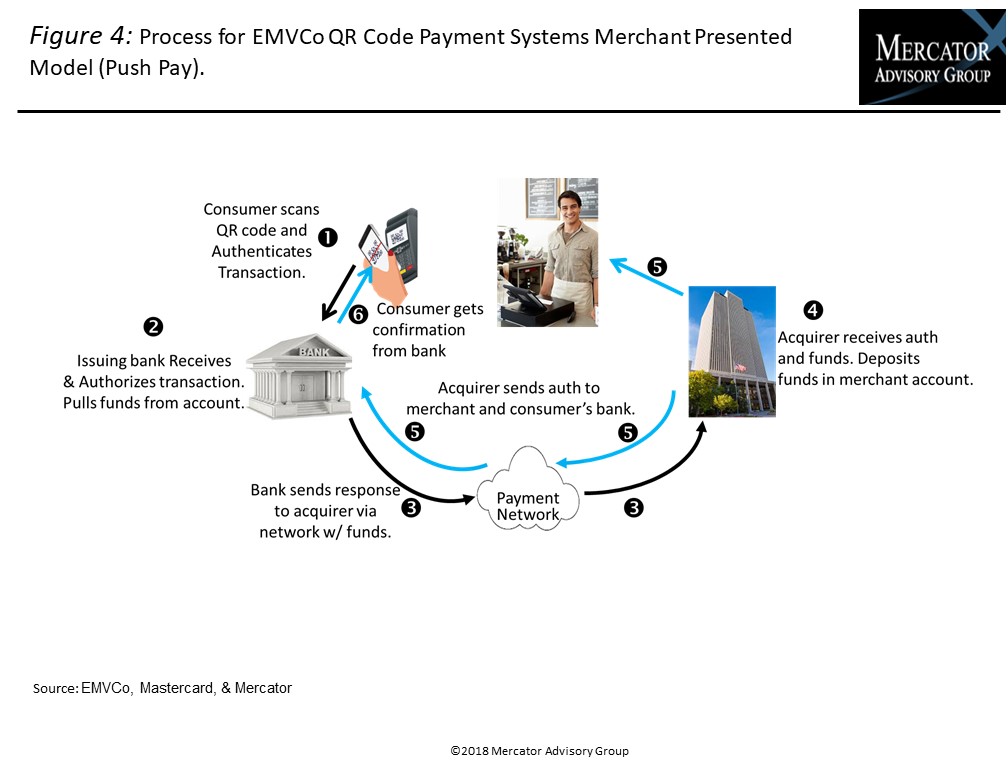

One of the exhibits included in this report:

- A brief history of efforts to improve the security and customer experience at the point of sale

- Detailed process flows for EMV, “quick” EMV, and consumer-presented and merchant-presented EMV QR Code

- Analysis of why NFC has not taken off in the United States and what might be done to change this

- Recommendations on how EMV QR could best be brought to market

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world