Overview

Boston, MA – March 16, 2012 – In new research, Evolution of Branch-Based Advice in Multichannel Banking, Mercator Advisor Group reviews the transformation many banks and credit unions have undertaken from teller-focused full-service business models to self-service or hybrid self-/full-service advice models as a strategy for increasing efficiencies while retaining high levels of customer interaction and advice.

“The dichotomy between being able to offer high levels of customer service while reducing the cost of sales presents significant challenges for financial institutions. Not only do they need to retain a highly valued, yet costly, branch presence, but also they must carefully evaluate projects that hold great promise for improved efficiencies, profitability, and interaction,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service.

This report is 24 pages long and has 10 exhibits.

Organizations mentioned in this report include: Apple, Bank of America, Coastal Federal Credit Union, Diebold, First National Bank of Omaha, JPMorgan Chase, KeyBank, TD Bank, uGenius, and University Federal Credit Union.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

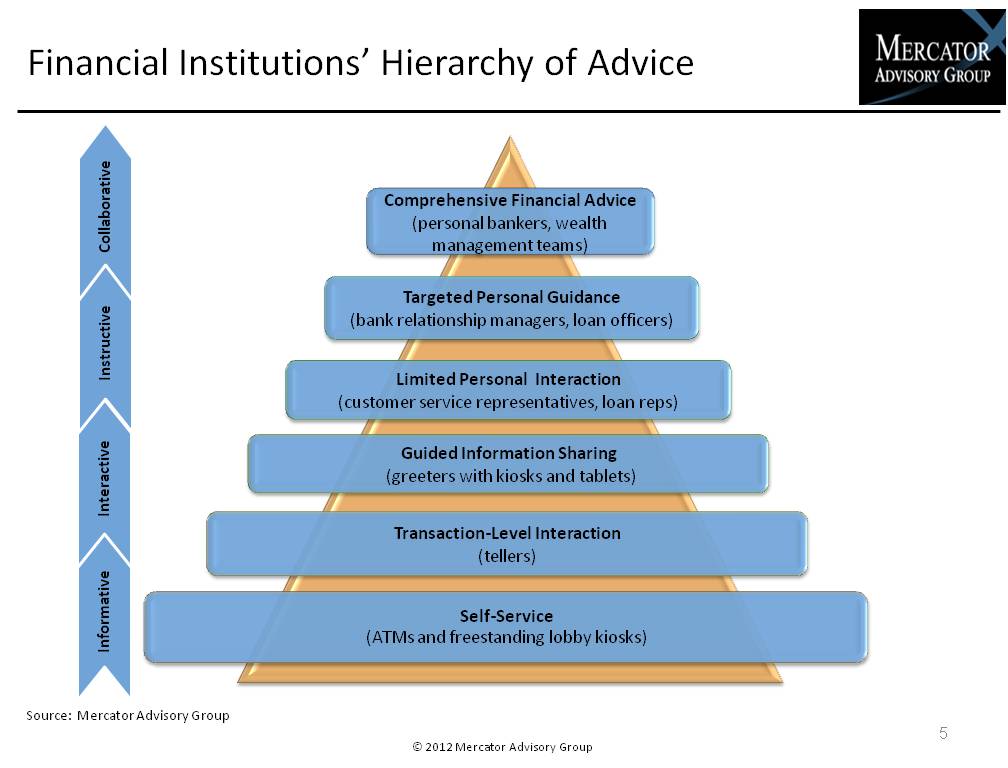

One of the exhibits included in this report:

Highlights of this report include:

- While the foundation of banking is still centered on the branch concept, the way that branch business is conducted is changing fundamentally.

- The formats of self-service banking customers are becoming accustomed to using and the opportunities this activity opens for FIs.

- The dilemmas FIs face and the models they should evaluate when finding ways to continue to offer high levels of customer service while reducing the cost of sales presents significant challenges for financial institutions.

Learn More About This Report & Javelin

Make informed decisions in a digital financial world