Overview

Boston, MA

November 2003

The Evolution of Debit:

Poised for Aggressive Growth

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

VISA, MasterCard, Wal-Mart, First Data, and Concord, to name only a few, are playing hardball, as is evident in the Wal-Mart settlement, the FDC/VISA legal imbroglio, and VISA's loss of $1.3B. In its new report "The Evolution of Debit: Poised for Aggressive Growth" the Mercator Advisory Group reviews the issues that make the Debit Industry a legal and economic battleground and predicts how the industry will grow.

Tim Sloane, author of the report, says that, "the traditional credit card associations remain in a dominant position but are fighting hard to maintain control against significant new market entrants. The competition include the Online Debit Network suppliers who are stealing market share and large merchants that, through consolidation, now directly influence the spending habits of a large number of consumers using loyalty programs."

|

|

According to this report, the associations still control the bulk of all transaction volume and are well positioned to influence consumers towards the debt instruments that favor consortia members, but the Wal-Mart settlement and other current litigation makes the future far from certain.

This report maps the flow of consumer spending and discovers that US Online and Offline Debit continue to evolve into a significant consumer option at the point-of-sale; primarily because of high merchant acceptance and an increasing number of issuer incentives that promote consumer adoption. It is becoming clear that merchants are a force this industry must reckon with, and by reviewing the post Wal-Mart fee structures and contractual relationships this report demonstrate the new found power of the merchant.

The EFT Networks are also flexing their muscles in this post Wal-Mart era. The report documents the increase in fees these networks charge and how the fees create new challenges for this historically merchant-favored online debit transaction settlement environment. The merchant influence through the Wal-Mart settlement on the offline fee structure, coupled with the responding rise in online debit, indicates the dynamic nature of this market and why it must be closely monitored.

|

|

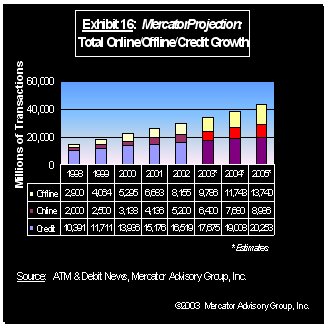

The report goes on to predict growth that favors the associations. While the growth rate for Offline Debit declined recently and gives the appearance of leveling off at ~20%, but Mercator Advisory Group projects the growth rate will soon increase again. Association members have a powerful influence over consumer behavior through signature-only loyalty programs and can influence merchants through rate reductions like those just introduced. Mercator Advisory Group predicts growth of 19% (compounded annually) from 2002-2005 for debit in the US and provides a breakout of online vs. offline and POS payment percentages (see exhibits 16 & 17).

"The Evolution of Debit: Poised for Aggressive Growth" explains the industry battles taking place, reviews the history that brings the industry to this point, the fee structures that simultaneously create alliances and competitors out of participants, and presents current transaction volumes and forecasts. A related report, "The Battle for the US Consumer: FDC, Wal-Mart and the Future of The Payments Industry" drills down into the major legal battles impacting the Debt Industry, the events that lead up to the Wal-Mart decision, provides a concise review of how the Wal-Mart decision impacted industry fees and contracts, and analyses the potential long-term impact.

This report contains 24 pages and 22 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world