Fighting Commercial Card Fraud and Bridging the Information Gap

- Date:November 24, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

A reality of the payments world is that fraud is increasingly prevalent and so must be the efforts to combat fraud. For commercial card programs, these efforts require a strategic balance among the stakeholders: the issuers, the companies, their employee cardholders, and solution providers. While commercial card fraud may not be in the headlines as much as fraud in other segments of the market, it is still a reality with many unique nuances that require attention.

Mercator Advisory Group's newest report, Fighting Commercial Card Fraud and Bridging the Information Gap, looks at the current state of commercial card activities relating to fraud and many of the opportunities for the stakeholders to build a collaborative approach to address both current and potential threats.

"Commercial cards have always had unique challenges to manage fraud,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Corporates with card programs have a variety of fraud tools to leverage, but they require strong levels of education from issuers and networks to become more comfortable using them. Fraud activities follow the money, and the complexity of commercial payments from invoice to payment requires diligence and understanding for potential weaknesses in the system.”

The note is 22 pages long and contains 5 exhibits.

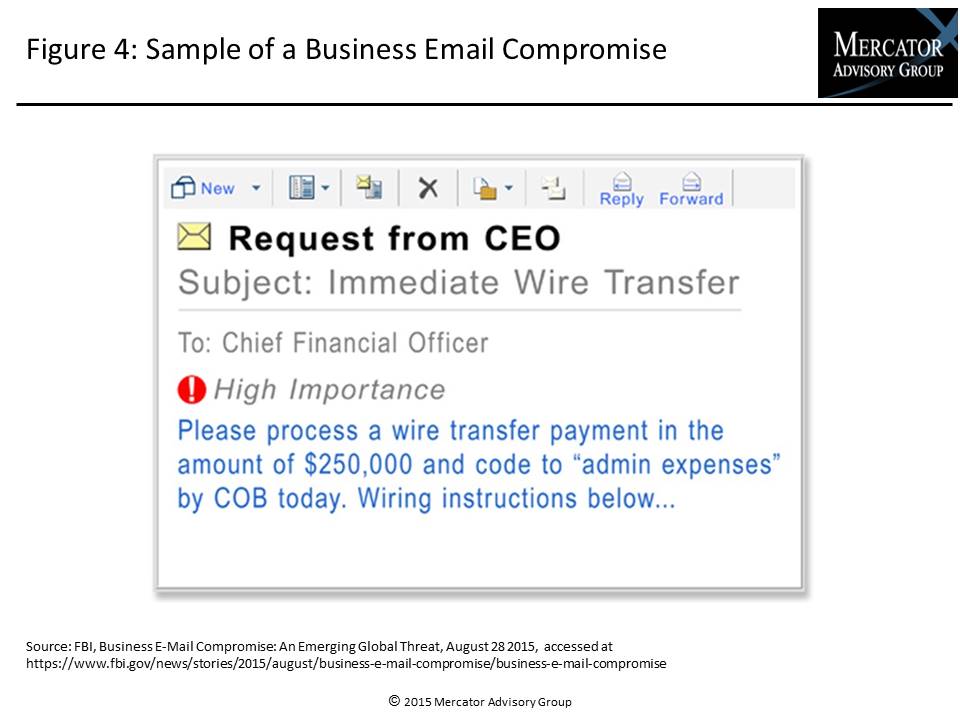

One of the exhibits included in this report:

Highlights of the report include:

- Fraud prevalence, losses and liability

- External fraud tactics and trends

- Prevention and protection from providers

- Technology for corporate card programs

- The importance of corporate and commercial card issuer relationships

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world