Overview

Boston, MA

November 2008

Financial Supply Chain, Payment Opportunities for Innovative Banks

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

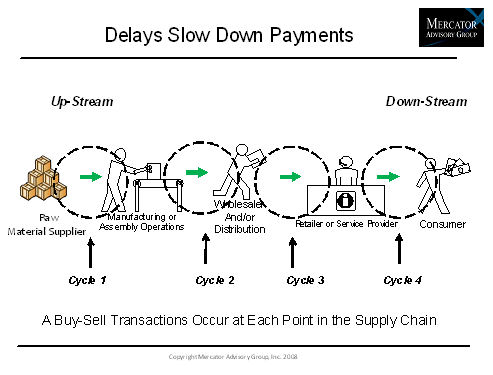

Supply chain management has proven to boost business performance and profitability. By making operational adjustments a business can increase their earnings per share as much as 20%. Financial supply chain deals with the business' cash flow up and down the supply chain. Businesses are shifting their attention to inefficient payments processing and adopting new strategies to maximize working capital and speed up cash flow.

At each step of a supply chain life cycle there are buy/sell transactions. A manufacturer needs to purchase raw material to produce their product. Their product is a component of a much larger solution purchased directly or indirectly through a distributor. Finally, the finished solution is sold to the end user. Each buy/sell transaction is part of a procurement-to-pay process that affects the buyer's and seller's cash flow. Any disruption potentially slows down the process and affects the entire cycle and impacts cash flow.

This report focuses on the financial side of the supply chain, in particular business-to-business payments. All businesses worry about cash flow. Small business owners will tell you their #1 cash flow problem is slow payments. Buyers delay payments as part of their cash flow management strategy. These slow payments are deadly to small business owners and cause large companies costly sourcing challenges.

Banks are in perfect position to help. They have traditionally offered their large corporate clients a choice of lending solutions for working capital. Solutions like lines of credit, asset backed loans, and invoice financing. Non banks financial companies offer factoring solutions and purchase order financing. Small businesses have limited choices and use credit cards and lines of credit. New open account payment solutions are emerging that will have a profound effect on businesses. The Internet connects buyers and sellers up and down the supply chain. Networks are speeding up paper documents, increasing transaction visibility and transparency. Supply chain management and finance are working together to improve company profitability.

One of the 14 Exhibits included in this report

Banks concerned about being disinter-mediated can play an important role by offering simple easy-to-use payment services. Businesses are looking to banks for purchase order and invoice management.

"Understanding the buy/sell transaction effect on cash flow within the supply chain is the missing link that connects the physical and financial supply chains", according to Sarsha Adrian, Senior Research Analyst at Mercator Advisory Group. "There's an opportunity for banks to insert bank credit for trade credit and simplify the entire process."

This report is 42 pages long and contains 14 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Learn More About This Report & Javelin

Make informed decisions in a digital financial world