Overview

First-Party Credit Card Fraud:

Trends, Analytics, and Prevention Strategies

New Research Sizes the Problem of First-Party Fraud in the

United States and Examines Countermeasures

Boston, MA -- Because first-party fraud, in which borrowers apply for and use credit with no intent of paying off their loans, has historically been difficult for credit card issuers to identify as intentional acts of theft, most lenders end up writing it off as bad debt. Recently, the payment industry and vendors that serve it have been intensifying efforts to combat first-party fraud as the criminal underworld exploits vulnerabilities in the banking and credit card system. Issuers have incorporated fraud prevention technologies to identify fraud rings and activity, weed out bad accounts, and respond with greater insight to cases of potential first-party fraud.

Mercator Advisory Group's new report, First-Party Credit Card Fraud: Trends, Analytics, and Prevention Strategies, examines first-party fraud by reviewing current market statistics on credit card fraud from a number of industry participants and national reporting bodies. The report presents credit quality data and discusses the type of environment that fosters first-party fraud.

Also included is Mercator Advisory Group's estimate of the scope of the first-party credit card fraud problem in the United States. The report describes strategies and vendor solutions and analytical tools for managing first-party fraud as well as some of the broader market implications associated with first-party fraud and banks' tactics when dealing with it.

"Part of building a strong case that demonstrates a first-party fraudster's intent is establishing a pattern of behavior that reveals it, but the best risk management policy is to cut off a fraudster's opportunity to steal in the first place," David Fish, Senior Analyst in Mercator Advisory Group's Fraud, Risk, and Analytics Advisory Service and author of the report, comments. "As fraud schemes increase in sophistication, it is all the more imperative for risk managers to harness the power inherent in broader data sets by applying analytic strategies that can detect correlations between seemingly unrelated incidents and identify behavior that may be predictive of fraudulent activity."

Highlights of this report include:

Definition and sizing of first-party credit card fraud in the U.S. market

The likely effect of easing credit policies (in future economic recovery) on first-party fraud

The steps processors and institutions will need to adopt to lower their risk of exposure

Industry wide steps needed to combat first-party fraud

Profiles of three vendors of fraud and risk management solutions indicating the direction of the industry's countermeasure strategies

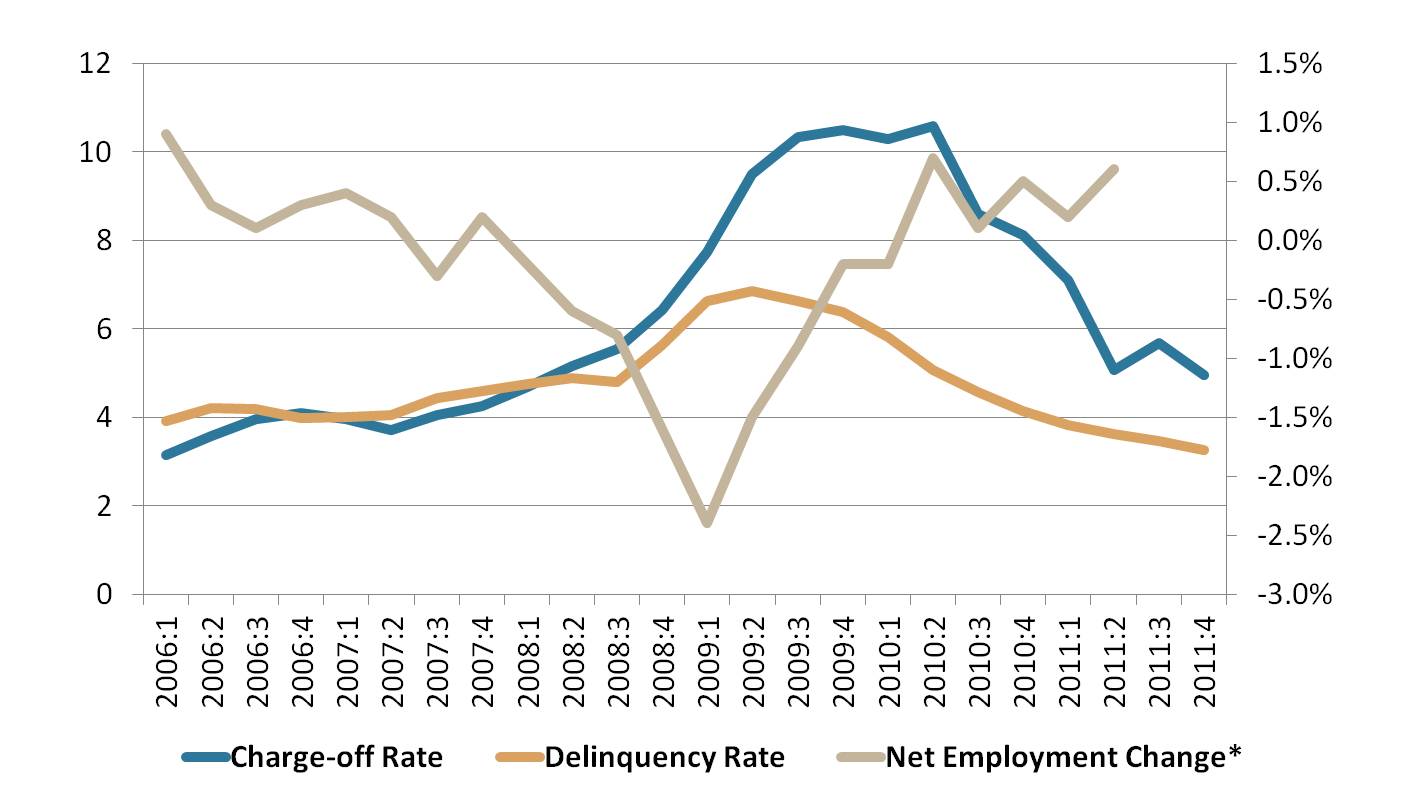

One of nine exhibits in this report:

U.S. Quarterly Credit Card Delinquencies and Charge-offs,

and Net Employment Change, 2006-2011

This report is 33 pages long and has nine exhibits.

Companies mentioned in this report include: ACI, CyberSource, Detica NetReveal, Early Warning Services, Equifax, Experian, FICO, Intuit, MasterCard, NICE Actimize, Opera Solutions, Palantir Technologies, PayPal, Square, Transaction Network Services, and Visa.

Members of Mercator Advisory Group's Fraud, Risk & Analytics Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world