Overview

Boston, MA

April 2008

Forget Older Baby Boomers: Younger Boomers Should Be the Focus of Aggressive Bank Marketing

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report from Mercator Advisory Group's Retail Banking Practice delivers concrete strategies importable by financial services firms targeting the underappreciated and under-marketed to Younger Baby Boomers (born 1955 - 1964).

While the Oldest Baby Boomer could be the mother or father of the Youngest Boomer, the breakout of two boomer segments has been only glancingly addressed in the financial services press. So while the industry has ostensibly courted the Boomers, it has, in fact, been singularly focused on Older Boomers.

The 38 million Older Boomers and the 41 million Younger Boomers grew up in very different societies which conspicuously molded the psychographics of the two groups. That in turn drove the different educational, housing, asset accruals and retirement sources of each. Older Boomers got a booming, post-war economy and John Kennedy. Younger Boomers got the Oil Crisis and Richard Nixon.

The Younger Boomers wield $1.1 trillion in spending power; represent 23 million of the nation's households and need products, services and guidance tailor crafted for the needs of its district generation.

As Younger Boomers entered the job market, pensions began disappearing and by 2006, only 18% of employees were covered by traditional defined benefit plans. It means that retirement products generating an assured, long-term yield are particularly attractive to Younger Boomers who fear they may outlive their investment portfolios. While many banks and financial planners have been targeting Older Boomers with their annuity pitches, it is Younger Boomers who need those products most acutely.

One of the marketing message challenges for investment professionals is the disconnect or denial Americans experience between their actual financial resources and retirement preparedness, and their sense of agency in being better off and more prepared that data shows. Typically, Americans, wildly overestimate their financial assets, underestimate their debt and have a crossed-fingers, play-the-lottery scheme for a comfortable retirement.

With the decline of traditional defined benefit pension plans, workers appropriately worry about their ability to self-fund their retirements. However, many of those worriers have failed to take any actions to pump up their own retirement portfolios and may in fact be intimidated by the financial planning tools offered to them.

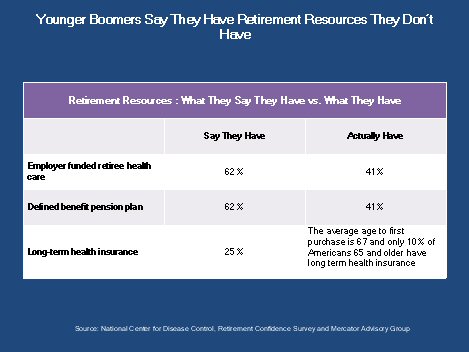

Responding to the Retirement Confidence Survey, 41 percent of Younger Boomer workers indicated they or their spouse have a defined benefit pension plan, yet 62 percent say they are expecting to receive income from such a plan in retirement.

Similarly chilling is that the same percentage of workers (62 percent) anticipates receiving retiree health insurance through an employer even though only 41 percent of workers receive that benefit.

A lack of awareness of the limitation of their own preparedness for retirement does not stop with retirement income and health care. Long-term care insurance protects many Americans from the destitution easily wrought by a long recuperation from illness or injury or even long term nursing home/home nursing care.

It is estimated that 70% of Americans will need to access long-term health insurance policies at some point in their lives. One-quarter of workers and more than one-third of retirees report they have long-term care insurance, but in fact, only 10 percent of Americans age 65 own that insurance product. Again, many Younger Baby Boomers are envisioning a future with coverage they do not actually have.

"Forget Older Baby Boomers: Younger Boomers Should Be the Focus of Aggressive Bank Marketing" addresses this second wave of Baby Boomers, Younger Boomers, overlaying a Who-Are-They assessment with a investigation of the marketing dialogues between banks and Younger Boomers that have occurred in benchmarkable banks and retailers and explore the ways this marketing effort could be both broadened throughout the financial services industry and honed to drive profitable business to banks and create true value and loyalty on the part of this afterthought wave.

One of the 11 Exhibits included in this report:

This report contains 27 pages and 11 exhibits.

Report Highlights:

- In the marketing barrage focused on the impending retirement of Older Baby Boomers, a larger opportunity is being overlooked: the financial products and advice needs of the 41 million Younger Baby Boomers with their $1.1 trillion in spending power.

- The Oldest Boomer could be the parent of the Youngest Boomer. Separated by numerous years, these two groups grew up in dramatically different Americas and will have wildly different resources available to them in retirement.

- Younger Boomers lacked the Older Boomers' access to employer-paid pensions and healthcare, inexpensive real estate, larger payouts of social security and even the top jobs of corporate America.

- Rather than allocate marketing budges to the over-messaged Older Boomer market, bank marketers should take a hard look at the psychographic and financial asset profiles of Younger Boomers and offer products for this undeserved cohort.

- Younger Boomers overestimate (wishful thinking?) their preparedness for retirement and their ownership of pensions and long-term healthcare.

- Younger Boomers need financial counsel and partnership to assemble an old-age-proof portfolio of annuities, new retirement savings strategies and long-term healthcare products.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of the report, comments, "Younger Baby Boomers, raised in a time of enormous cultural and economic stress are far less prepared for retirement than the Older Boomers who have received the non-stop, numbing attention of the financial services industry's advertising campaigns. The Younger Boomers are in their 40's and 50's so they still have years to beef up their retirement preparedness, but they have a slew of challenges facing them.

Unlike Older Boomers, Younger Boomers did not work in corporate America offering pensions or retiree health insurance through an employer. They have not amassed the same savings as Older Boomers because they have spent their working lives further down the corporate ladder reporting to their Old Boomer bosses and watching their real incomes wane a little bit more each year. They still have children at home, are saddled with debt and are frustrated that they don't make as much money as did their parents.

We believe strongly that financial services firms willing to partner with Younger Boomers in co-creating a life-long income strategy have a huge advantage in serving a market of almost limitless potential. The needs of the group are clear and it is a win-win to realize profits while ensuring the long-term financial health of one of America's largest cohorts."

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Make informed decisions in a digital financial world