Overview

Gateway Providers Look Toward the Cloud:

There'll Be a Lot of Company Up There

Boston, MA -- Jan. 6, 2010 -With margins on transaction switching thinning, gateway operators are increasingly competing on features at both the edge of the network and within their own data centers. Client-side code and devices are one avenue. Smartphone-based APIs and iPhone "sleds" for magstripe card payments are examples. And in the core of the network, a growing lists of payment services add value to traditional transaction switching through increased security, lowered risk and programmatic access.

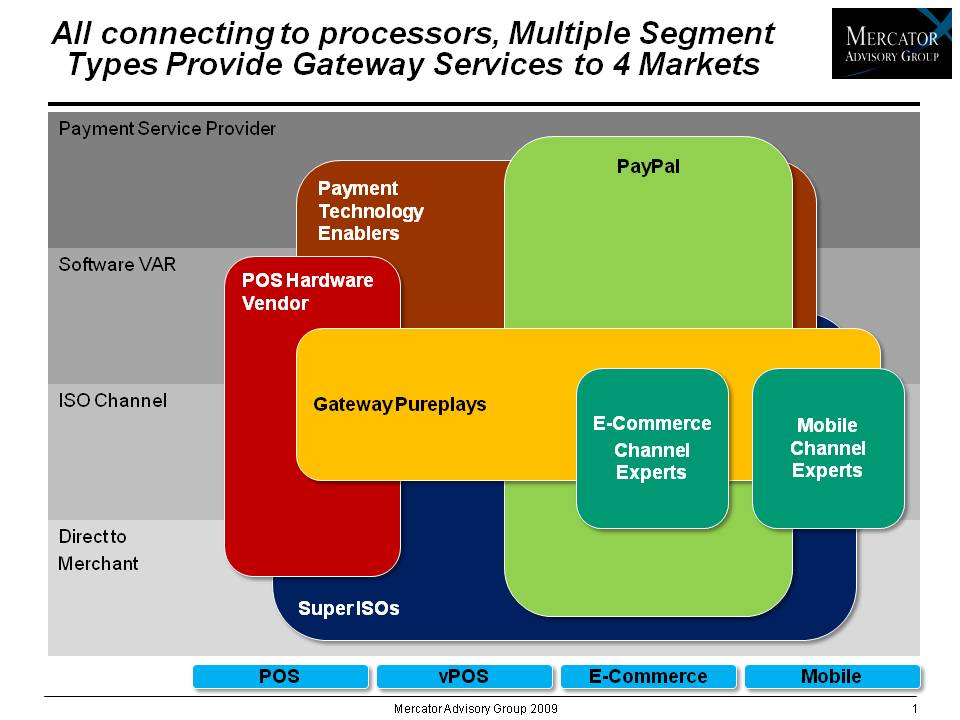

In a new report, Gateway Providers Look Toward the Cloud: There'll Be a Lot of Company Up There, Mercator Advisory Group examines the future of payment gateways and the expanding set of services they offer to ISOs, software VARs, merchants and payment service providers. The report also analyzes the growing cadre of competitors in the gateway market.

"The simple gateway is moving from its switching roots to a far more sophisticated platform for delivering payment-related services," said George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service and principal analyst on the report. "Given the attractions of the payments industry, new entrants are arriving and existing players are expanding the services they offer to attract, in particular, two important markets: software VARs and merchants. The security models of cloud-based service delivery are about to get some serious exercise."

Highlights of the report include:

Gateway services providers have fought the margin battle for payment switching to a standstill.

Margins are tight and the game is all about increasing volume through broader channel supportMargins for gateway providers will come increasingly through offering multiple services to their merchant and sales channel partners.

Advanced features that directly meet merchant concerns include card number tokenization and token "vaulting", and recurring payment management. More traditional services include support for signature capture, fraud controls and rewards programs.

Support for App Phones, especially the iPhone, is almost universally considered a requirement by pureplay gateway providersGateway services lend themselves to cloud-based operation.

Implications include growing competition from non-traditional providers as well as a heightened focus on the security posture of cloud-based services.

One of 6 exhibits in this report

This report contains 22 pages, 6 exhibits.

Companies and programs mentioned in this report include: Authorize.Net, CyberSource, First Data, TSYS, Chase Paymentech, Apriva, MagTek, Intuit, Way Systems, MerchantLink, Micros, IP Commerce, ProPay, Miva, Shopsite, Amazon, TNS, Mercury Payment Systems, USA ePay, Charge Anywhere, and eProcessing Network, Litle & Company, VeriFone, Semtek, PayPal, Square, Inc., mFoundry, Google, and Salesforce .

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send E-mail to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments industry. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, and associations to leading technology providers.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world