Overview

A new research report titled General Purpose Reloadable Prepaid Card Portfolio Measurements and Growth Strategies has been released by Mercator Advisory Group that provides a deep dive into the challenges GPR program managers face due to an ever-churning cardholder base and continued regulatory instability. The report examines account acquisition, retention, KPIs, and methods for growth and discusses four specific KPIs that can be used to determine the financial health of the portfolio and methods for increased non-cardholder fee income.

"Providers of GPR prepaid debit cards should be evaluating their businesses and looking for ways to maintain and increase revenue," comments C. Sue Brown, Director of Mercator Advisory Group's Prepaid Advisory Service and author of the report. “Opportunities shift as economic and regulatory changes cause the card market segments to shift in volume from year to year. Because of these shifts, for GPR card portfolios to be successful, program managers need to continually measure and monitor key performance indicators to determine if any changes are needed in the program to maintain or improve profitability. The results of the KPIs can indicate what needs to be changed and where, not only in marketing but in features and functionality of the cards.”

This research report is 16 pages long and has 5 exhibits.

Companies mentioned in the report include: Ace Cash Express, American Express, BB&T, Chase, ChexSystems, Green Dot, H&R Block/Intuit, HubSpot, Leanplum, Localytics, Netspend (TSYS), Marketo, Pardot, PayPal, TeleCheck, US Bank, Walmart, and Western Union.

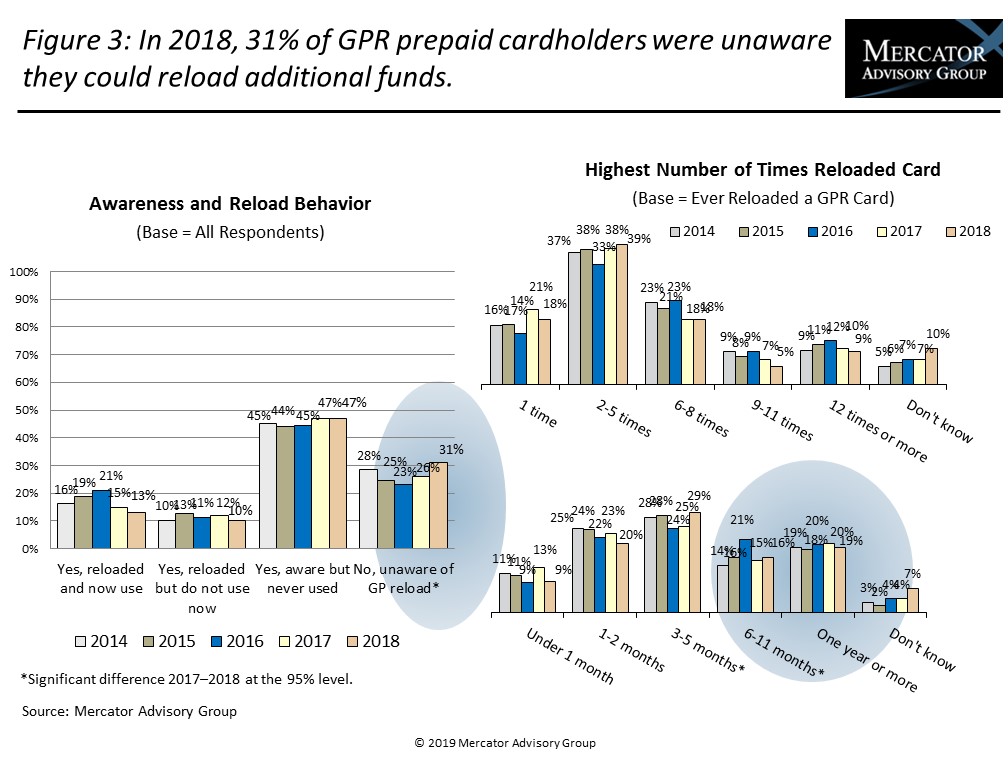

One of the exhibits included in this report:

Highlights of the report include:

- The nuances of a general purpose reloadable prepaid debit card program

- Four key performance indicators, or KPIs, for general purpose reloadable portfolios and their formulas

- The size of the GPR prepaid debit card market in the U.S. in 2017 and a forecast for its growth

- Revenue-generating methods other than increasing cardholder fees

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world