Overview

January 2009

Boston, MA

A Guide to Achieving Greater Prepaid Volume: Six Channels That Drive Prepaid Success

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report from Mercator Advisory Group, "A Guide to Achieving Greater Prepaid Volume: Six Channels That Drive Prepaid Success" delivers a in-depth analysis of six different channels utilized by the prepaid industry and then evaluates the impact each channel has on four different prepaid product segments: One Loop Gift Cards, Open Loop General Purpose Reloadable (GPR) cards, Closed Loop Retailer Gift Cards and Closed Loop Online Services prepaid cards typically used to deliver online music, games, and telecommunication services. The six channels evaluated include: 1) Issuer Indirect via Prepaid Mall Distribution; 2) Issuer Indirect through Non-competitive Retail Partners; 3) Issuer Direct via Web Site Distribution (to consumers); 4) Issuer Indirect via Direct Sales to Businesses (for incentives/rebates/gifts); 5) Issuer Indirect via Internet to Businesses (for incentives/rebates/gifts), and; 6) Issuers Indirect via Prepaid Internet Aggregators.

This research indicates that today the retail channel has proven instrumental in achieving high volume, as indicated by the fact that six of the ten fastest growing market segments have achieved their volume primarily through retail distribution. However it also finds that the number of cards sold through the internet has increased dramatically of late, but that some segments remain unable to leverage the internet channel for reasons explained in this report.

This report is the second in-depth look at prepaid card distribution models conducted by Tim Sloane, Director of the Prepaid Advisory Service for Mercator Advisory Group and the author of this report who states; "There have been several dramatic changes in the structure of prepaid channels and this report will help program managers of both open and closed loop products better plan their distribution strategies. It is amazing how sophisticated some program managers are in regards to their channel strategy while at the same time most others appear to lack any understanding of channel differentiation. For example, digital content providers typically demonstrate the most immature channel strategies, even as Apple clearly demonstrates that huge volumes are possible when you move digital content into the world of physical gift cards. This report also takes a special look at how consumers that purchase prepaid cards for budgeting purposes represent a huge challenge and opportunity to financial institutions that control the consumer's DDA account. While to date retail banks have not been hugely successful in prepaid, it appears a major opportunity is approaching."

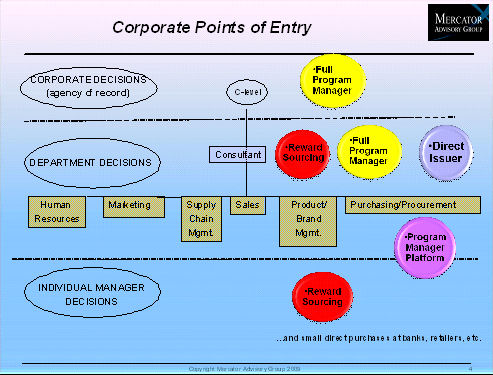

One of the 2 Exhibits included in this report.

The report is 26 pages long and contains 2 exhibits

Other recently released Prepaid Advisory Reports:

| Prepaid Market Forecasts to 2011 | |||||||||

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to: [email protected]

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world