Overview

Payments Orchestration Benefits Merchants in Rapidly Changing Payments Ecosystem.

Mercator Advisory Group’s most recent report, A Guide to Payments Orchestration, provides insight into this exciting new technology and explains what every merchant needs to know about it.

Payments orchestration is a relatively new term in the payments lexicon, but one that is becoming more widely discussed among merchants of all sizes, types, and categories. The strategy that drives orchestration is nothing less than a paradigm shift in the way that merchants view payment service providers. Rather than conduct due diligence to select a “best-of-breed” service provider for each functional area within payments, orchestration leverages technology to utilize multiple providers, coordinating the utilization of each provider based on business conditions and/or transaction attributes.

The pace of change in the payments ecosystem makes it increasingly difficult for any single service provider to offer a complete solution in a specific category. Merchants are often disadvantaged by waiting for their primary service provider’s product development cycle to deliver needed features and functionality, but at the same time not always in a position to change that relationship. Instead, merchants are increasingly finding that the fastest path to adding needed services is by adding an additional service provider that already offers the needed functionality. Managing multiple service relationships across multiple payment service categories can strain a merchant’s operating resources, so more and more merchants are leveraging an orchestration strategy to deliver both a strong ROI and a superior customer experience.

An increasing number of merchants are employing an orchestration strategy to make payments work better in their businesses and deliver a better customer experience. However, orchestration is complex and has the potential to be costly if implemented incorrectly. This report examines the business factors that make an orchestration strategy useful and how to determine if you will benefit from orchestration, and then presents a guide for implementing orchestration successfully.

“This is a highly relevant and impactful report,” stated the author of the report, Don Apgar, Director of the Merchant Services and Acquiring practice at Mercator Advisory Group. “We are following this among a number of similar technology trends that are making payments a frictionless and invisible part of our everyday activities.”

This report is 16 pages long and contains 6 exhibits.

Companies mentioned in this report include ACI, BlueSnap, checkout.com. Ford, Gr4vy, Payoneer, Spreedly.

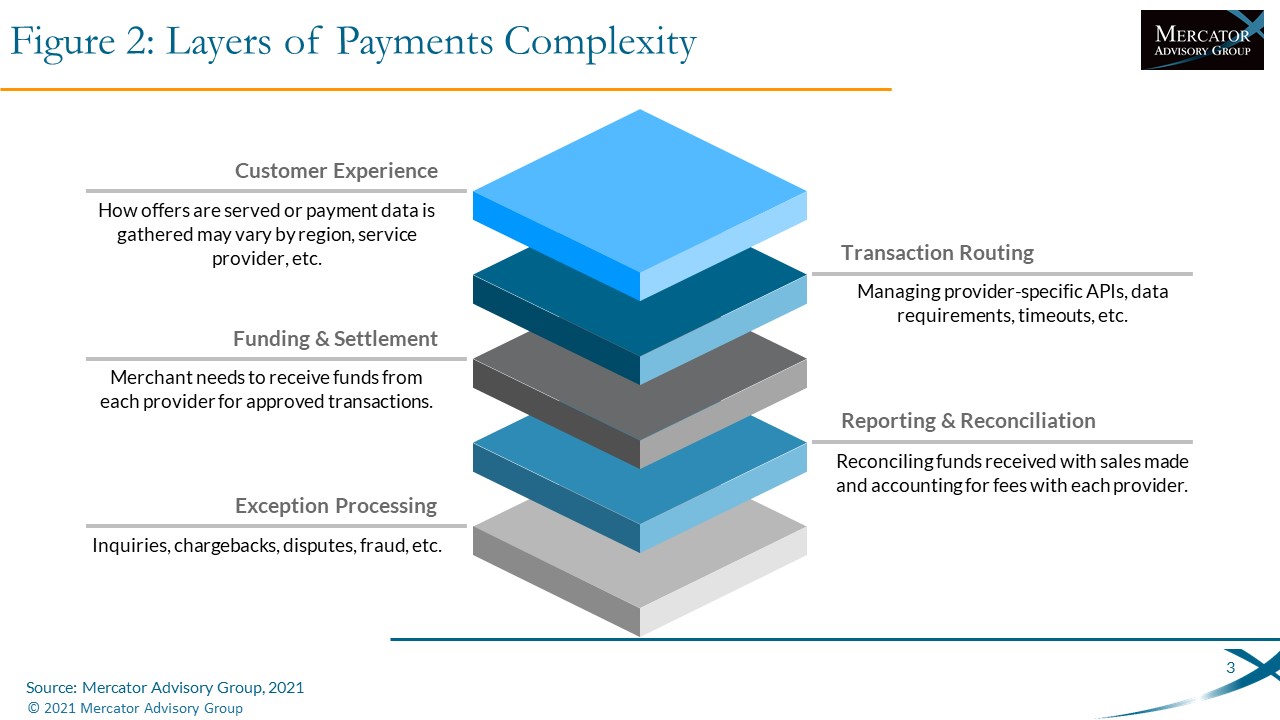

One of the exhibits included in this report:

A Guide to Payments Orchestration

Highlights of this report include:

- An outline of the benefits of payments orchestration

- An examination of the business factors that make an orchestration strategy useful

- A discussion on how to implement orchestration successfully

Learn More About This Report & Javelin

Related content

Surcharging on Card Transactions: In Search of Balance

The decision by a merchant to impose a surcharge on credit card transactions—usually a percentage of the purchase price to offset the cost of card acceptance—is understandable but ...

Payment Orchestration: Making the Juice Worth the Squeeze

Payment orchestration has come to the forefront as enterprise merchants work to squeeze the most from their payment platform. In addition to optimizing authorization rates, merchan...

Implementing Pay-By-Bank: A Guide for Merchants

Many merchants are exploring alternative ways to accept payments from customers and reduce the rising cost of accepting card payments, but is the U.S. banking infrastructure ready ...

Make informed decisions in a digital financial world