Overview

Payments for health care related services in the United States are estimated to total nearly $3 trillion annually, or 17.9 percent of gross domestic product. As costs continue to rise and employers look to provide meaningful health care benefits while complying with regulatory requirements, there has been a dramatic shift in consumers’ share of the costs. Consumers now pay not just their share of monthly insurance premiums but also co-pays and co-insurance expenses they owe directly to their health care providers. For the payments industry, payments has shifted from a business-to-business (B2B) environment, in which payers—the insurance companies and government entities—settled with the health care providers, to a consumer-to-business (C2B) relationship, in which doctors seek to collect payment in part directly from their patients. This shift represents an opportunity, according to Mercator Advisory Group’s research, Health Care Sector Opportunities for Acquirers.

The maze and fragmentation of stakeholders in creation and settlement of a health care payment transaction have made it difficult for merchant payment solution providers to know how best to meet the needs of this market and capture its business. Nonetheless, the trillions of dollars in consumer-based payments and transactions make this an attractive market for acquirers to enter. This Mercator Advisory Group research note explores the complexities and some promising approaches for easing the pain for health care providers who must collect payments from patients.

“Until the market has fully digested the impact of the Affordable Care Act and regulatory activity dealing with health care and health care payments, it is impossible to pinpoint exactly where the best opportunities lie. For processors, software integration and marketing partnership may prove to be a good way to stay in the mix, understand the shifts in this market, and be in a position to forge more comprehensive solutions when the uncertainties are cleared away,” commented Ken Paterson, V.P. Research Operations, and Director, Credit Advisory Service.

This research note contains 11 pages and 6 exhibits.

Companies mentioned in this report include: A-Claim, Chase Paymentech, eClinicalWorks, Elavon, Global Payments, InstaMed, mPay Gateway, Navicure, Patientco, Phreesia, Pokitdok, RevPoint Healthcare Technologies, Royal Solutions Group, TransEngen, TransFirst, and Vantiv.

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

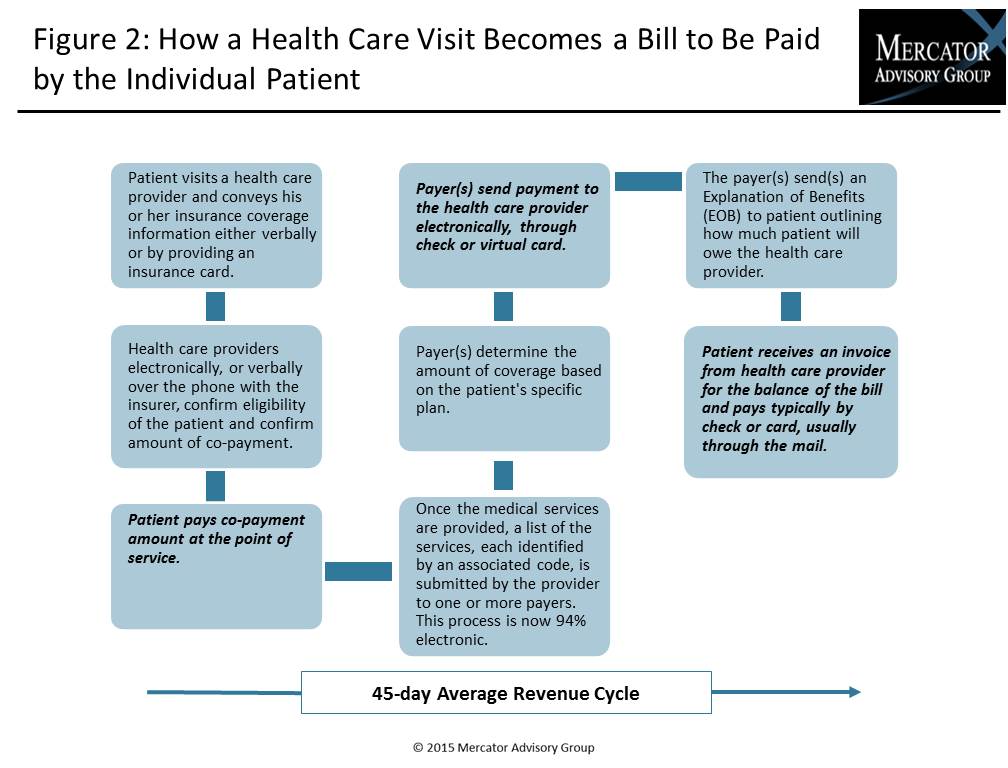

One of the exhibits included in this report:

Highlights of the research note include:

- The impact on U.S. consumers of the shift from business-to-business insurer payment of medical costs to more direct consumer-to-business payment

- The impact on health care providers

- The payments industry’s reaction

- Sample partnerships of payment industry players to provide acquiring solutions

- Description of a sample of innovative health care payment solutions

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world