Overview

How Close Is Proximity? Part I:

NFC Proximity Mobile Payments in 2009

Boston, MA -- Jan. 07, 2010 -- Plagued by unresolved technical and business issues, the global NFC market has been moving slowing over the past several years. The finalization of the NFC implementation standards, together with other technical issues, took much longer than people had expected, largely due to the business struggles between different industry groups. The global economic crisis started in 2007 also slowed down the industry's effort to come up with a workable solution acceptable to different parties in the ecosystem.

Even so, significant progresses are made on the technology front over the past two years. As NFC standards were finalized when the Single Wire Protocol (SWP) was adopted by ETSI in 2008, manufacturers of NFC chips, SIM cards, and handsets are finally able to move forward in developing the new generation of NFC solutions. But viable business model remains elusive and no major commercial roll-outs have been announced.

"NFC has come a long way. And different industry groups recently made some encouraging progress in finalizing the technical standard issues for mass production. But mobile operators and financial institutions are running out of patience as the market drags on and major commercial roll-outs worldwide not expected until 2012." Terry Xie, Director of Mercator Advisory Group's International Advisory Service and principal analyst on the report, comments. "Though NFC solutions are still considered the best long-term solutions for offering proximity mobile payment and other services, some industry players are seriously considering other options that allow them to move quickly in the market with some simpler technology and less business issues to resolve. The next two years will be very important for kick starting market initiatives in proximity mobile services. And various vendors are working hard to offer different innovative solutions."

Mercator Advisory Group's International Advisory Service (IAS) covers this much discussed indsutry topic in two reports:

How Close Is Proximity? Part I: NFC Proximity Mobile Payments in 2009

&

How Close Is Proximity? Part II: Alternative Proximity Mobile Payments in 2009

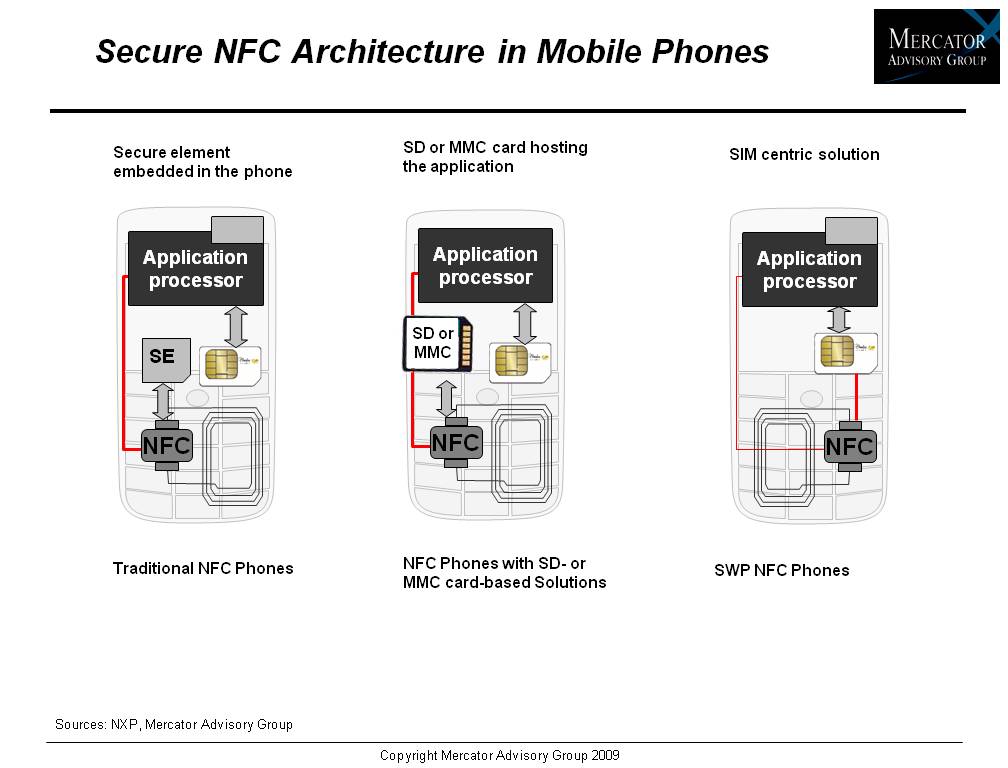

This first of two reports explores main technology issues that have delayed the finalization of the NFC standards and the business reasons behind them. Then it provides an overview of recent progress in the technical standards, especially the Single Wire Protocol (SWP) and its implications for the evolution of proximity mobile payment systems. The report also looks at the latest developments in the manufacturing of NFC chip/handset/SIM compliance with the latest standards, as well as in the testing and deployment of NFC proximity mobile payments in country markets around the world.

Highlights of thi report include:

After a delay longer than many had expected, the NFC standards are finally agreed upon, paving the road for large-scale manufacturing of NFC handsets.

MNOs and FIs have yet to find final solutions to their disagreements on business models. But encouraging signs suggest that mobile operators might be willing to settle for a SIM-rental fee instead of a transaction fee.

Tremendous work still needs to be done to resolve remaining issues before mass deployment of NFC-proximity mobile payments. Mercator believes that significant commercial roll-out worldwide won't happen until 2012, though some markets will move faster than others.

A wide variety of NFC trials were underway in 2009, most in single national markets, as stakeholders cooperated to resolve their differences and test new applications.

Critical issues remain for FIs to resolve, including a means for influencing their applications' placement in the mobile "wallet," as well as setting the rules governing the certification of payment applications.

One of the 2 Exhibits included in this report:

This report contains 26 pages and 2 exhibits.

Companies covered in this report series include: Watch Data, Bladox, Zenius Solutions , TWINLINX, Tyfone, DeviceFidelity, INSIDE Contactless, NXP, Sagem Orga, Motorola, Sony, Nokia, Apple, Research In Motion, Fonelabs, Visa, MasterCard, First Data, NationZ, and China Mobile, among others.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world