Overview

While there have been misguided statements suggesting that Bitcoin is the next Internet, this would be true only if the analogy were limited to a growth metric and not a technological comparison. The Internet is simply a network enabling interoperability between cooperating entities. This is totally unlike Bitcoin. This Note evaluates the potential impact if new solutions with significant volume embed proof of ownership into the Bitcoin blockchain for long-term assets, such as stock holdings, property, or car titles.

“Marc Andreessen is correct that the Bitcoin trust algorithm is a fundamental breakthrough in computer science, but the construct of Bitcoin operations that incent Bitcoin ‘miners’ was not part of that mathematical proof,” said Tim Sloane, VP, Payments Innovation, and author of report. “Bitcoin embodies social science associated with the behavior of the miners, developers, and others; political science within the voting process that determine future enhancements; economic theory which establishes the value of bitcoin required to keep miners incented to mine for trust; and computer science that guides the software development, distribution, and management that keep this whole crazy Bitcoin ecosystem operational. This research note evaluates what might happen if significant volume of low-value transactions is added to Bitcoin and provides recommendations”

This research note is 12 pages long and contains 3 exhibits.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this research note as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

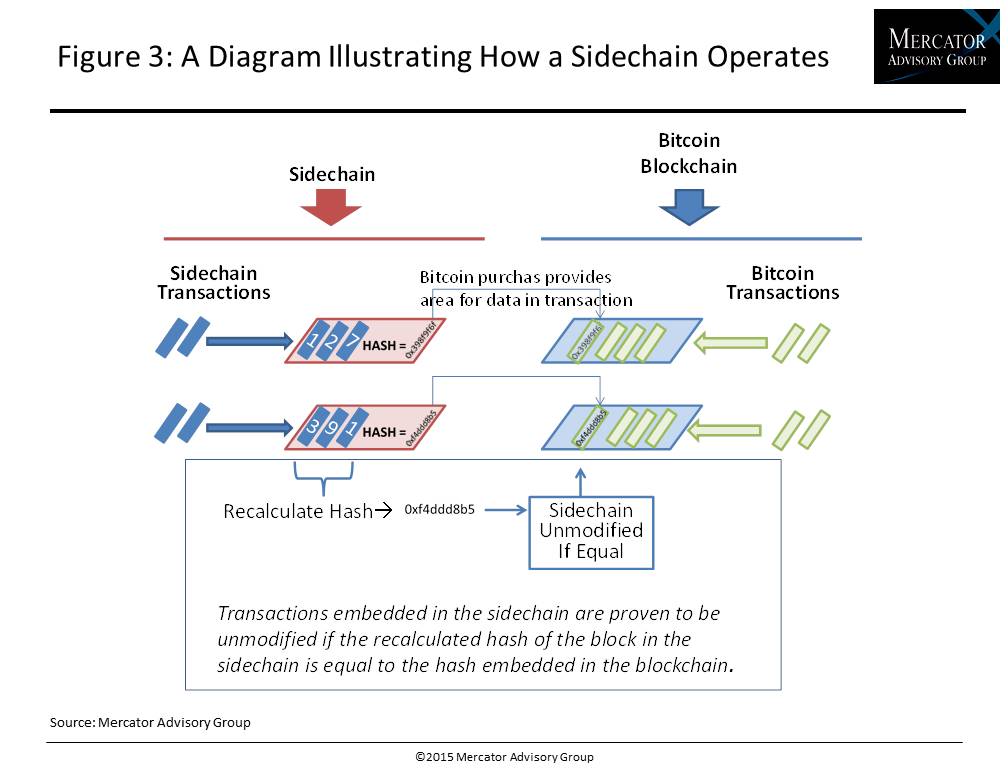

One of the exhibits included in this report:

Highlights of the report include:

- Mercator Advisory Group’s definition of a sidechain and identification of technological mechanisms for implementing sidechains

- An overview of what Mercator terms “the Bitcoin economy,” which links the attributes of value, transactions, fees, and Bitcoin miners in a balanced choreography

- The brittleness of this choreography and documentation of examples of situations that tested that brittle nature

- Discussion of new approaches to sidechains that have been documented, with identification of where they will likely add significant value and where they continue to risk breaking the Bitcoin economic model

- Mercator Advisory Group’s recommendations for managing the risks outlined

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world