Overview

Boston, MA

June 2007

HSA-Linked Credit: Putting Dough In The HSA Doughnut Hole

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the emerging market for consumer credit facilities to bridge the gap between a subscriber's out-of-pocket medical expense obligations under a high deductible health plan (HDHP) and any accumulated assets held in a health savings account (HSA). High deductibles are what HDHPs economically attractive in terms of lower premiums. The funding gap is intended to be filled by assets from consumers' HSAs, which offer a tax-advantaged savings vehicle for HDHP participants. Topics explored include:

The structural gap between out of pocket expenses under a high deductible health plan and any potential HSA-based savings creates an opportunity for credit extension.

HDHPs are growing quickly from a small base, although the future growth trajectory is questionable. Credit facilities for employees could actually enable more employers to adopt HDHPs.

Early credit experience with HDHP participants has been positive, but may be colored by early adopters who are healthier and wealthier.

Credit providers so far have focused on two primary models: extending a line of credit to individuals, or underwriting a broad employer based group through payroll deductions.

HDHP-related credit could reach $1.5 Billion in outstandings by 2010.

The study examines the emerging needs for credit under these plans, and the approaches taken by early providers addressing the market need. Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report comments that, "An analogy often made is that the shift to HDHP's is like the shift from defined benefit pensions to defined contribution 401(k) plans. HDHP participants and sponsors work under specified contributory limits and responsibilities, much like a 401(k). But a key difference is that you can, in theory, plan for retirement in a specific year, or you can move the date around a bit at your discretion if circumstances permit. It is a lot harder to time a medical emergency for that date when your HSA balance will cover your deductibles. So into the breach rides credit, and a number of early market entrants are demonstrating the need can be met using a variety of approaches. Credit may in fact come to play a critical role in increasing the appeal of HDHPs for employers concerned about employees' ability to meet their out-of-pocket obligations."

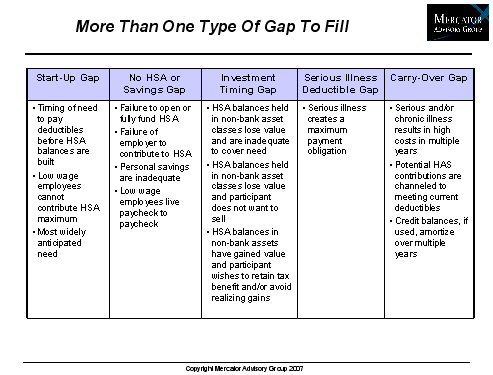

One of the 8 Exhibits included in this report:

The report is 27 pages long and contains 8 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world