Overview

Lifestyle commerce sets the pace for retail sales growth.

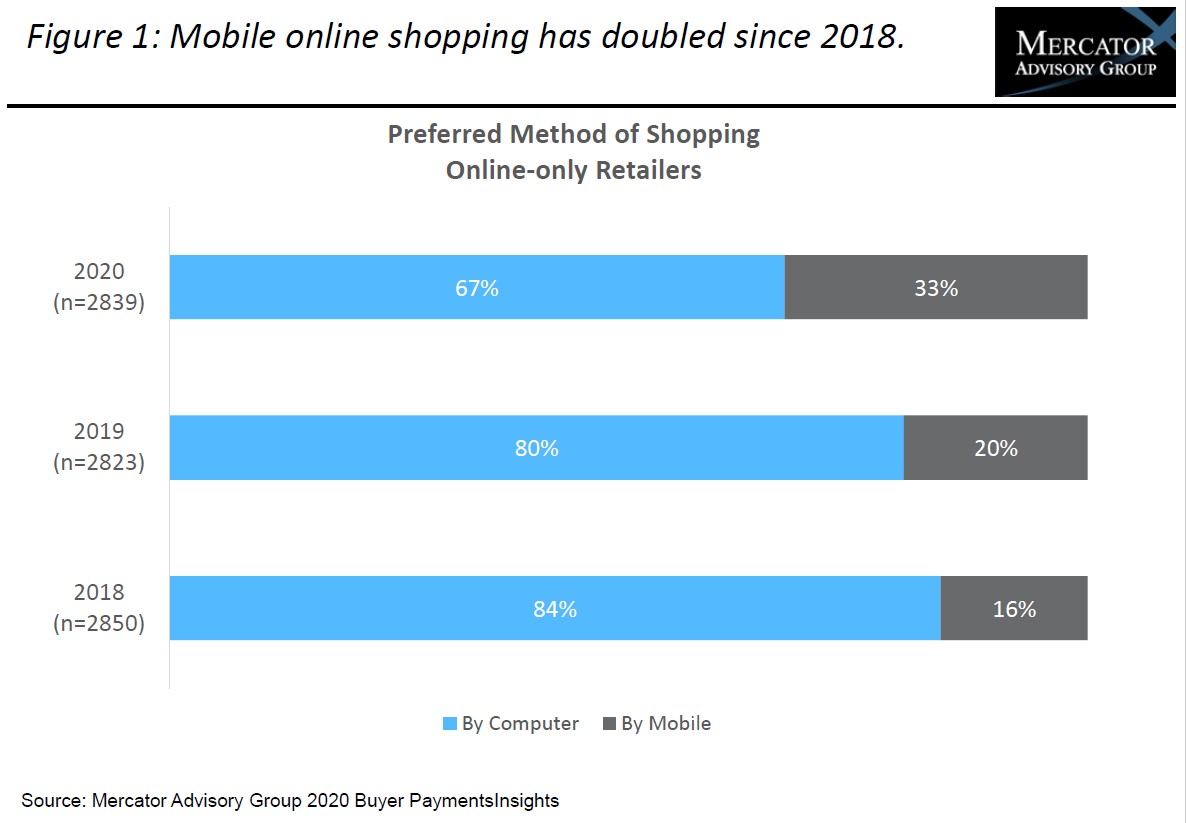

Lifestyle commerce is a prime mover of the customer experience journey that includes using mobile apps and payments as a key channel for retail shopping. It’s not only that e-commerce has grown, but more significantly, that mobile technology plays a larger role in the checkout process both for remote and proximity payments. Mobile use for pre-buy research and payments is a greater part of retail sales than much of the conventional wisdom now believes. A new research report from Mercator Advisory Group, Lifestyle Commerce Drives Expanding Mobile Sales Channel For Merchants, focuses on how retailers can leverage consumer mobile usage.

“Mobile is increasingly the go-to choice for shopping, ordering, and paying for many consumers. Mobile devices enhance the customer experience and provide merchants more opportunities to connect with consumers whether in-store or online,” commented Raymond Pucci, Director, Merchant Services Practice at Mercator Advisory Group, the author of this report.

This report is 16 pages long and has 6 exhibits.

Companies and other organizations mentioned in this report: Ahold Delhaize, Albertsons, Amazon, Best Buy, Burger King, Caviar, Chick-fil-A, Chipotle, Domino’s, DoorDash, Dunkin’, FreshDirect, FutureProof Retail, Grubhub, Kroger, Mercatus, National Retail Federation, Panera Bread, Postmates, Shipt, Starbucks, Subway, Taco Bell, Target, Uber Eats, Walmart, Wegmans, and Whole Foods.

One of the exhibits included in this report:

Highlights of this research report include:

- Sizing of the U.S. mobile payments market

- Mobile device use across a wide variety of shopping activities

- Consumer behavior patterns in mobile payments

- Demographics of consumers using mobile phones

- Leveraging of mobile solutions for retail sales growth

Learn More About This Report & Javelin

Related content

Surcharging on Card Transactions: In Search of Balance

The decision by a merchant to impose a surcharge on credit card transactions—usually a percentage of the purchase price to offset the cost of card acceptance—is understandable but ...

Payment Orchestration: Making the Juice Worth the Squeeze

Payment orchestration has come to the forefront as enterprise merchants work to squeeze the most from their payment platform. In addition to optimizing authorization rates, merchan...

Implementing Pay-By-Bank: A Guide for Merchants

Many merchants are exploring alternative ways to accept payments from customers and reduce the rising cost of accepting card payments, but is the U.S. banking infrastructure ready ...

Make informed decisions in a digital financial world