Overview

Boston, MA

September 2008

Loyalty & Rewards Bank Retention Strategy

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report from Mercator Advisory Group's Corporate Banking Advisory Service explores loyalty and customer retention from a banking perspective, specifically how and why these principles can be applied to build stronger business banking relationships.

On the web, customers can be induced to defect with a click of a mouse. That ease of attrition, in conjunction with the high cost of acquiring new customers, means that banks must vigilantly, and continuously, compete for their current customers, particularly their most long-term and profitable ones.

Banks focusing on customer retention are developing convenient and easy to understand loyalty and rewards programs around their debit and credit card solutions, rewarding both consumer and business customers every time they use their cards. Others are using 360 degree views of their corporate customers to reward account-holders for the full range of their asset and credit relationships with the banks.

This report also looks closely at the effectiveness of some large commercial bank loyalty programs, the complexities of these reward programs, and explores industry best practices. In some industries, loyalty programs generating a 5% improvement in customer retention can nearly double profits in five years. Finally, we suggest how banks developing programs that recognize their most profitable loyal business customers can differentiate themselves and their marketing messages in the marketplace.

For the banking industry, the overarching question is: Can banks learn the science of loyalty, build the data warehouses, do the transaction analysis and segmentation, craft reward programs that truly identify their very best customers, reward them with the right products, and accurately measure their success? Banks are sitting on billions of bytes of valuable consumer data, but that data is being held captive by organizational structures and legacy applications, making them difficult to centralize.

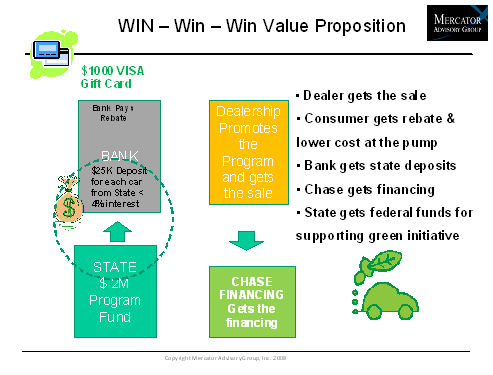

One of the 5 Exhibits included in this report

While loyalty and rewards programs involve both significant upfront and continuing outlays of capital, they also diminish the need for even more expensive account acquisition programs. By aligning resources with bank goals of cross-selling and deepening business banking relationships, banks realize significant cost savings and both current and future revenue.

A successfully implemented and marketed loyalty program can increase customer retention by 5% which in turn can increase a bank's profits as much as 100%. That same loyalty program can reduce a business bank's customer attrition rate by 20%.

This report also critiques the effectiveness of large bank loyalty and reward programs and also includes examples of the distinctive programs non-banks are successfully deploying to leverage their core strengths.

Sarsha Adrian, Senior Research Analyst in Mercator Advisory Group's Corporate Banking practice and author of this report, comments, "Surveys of financial services customers find that while 75% of respondents say that they are "satisfied," only 34% say they are truly loyal to their banks. Loyalty and reward programs successfully drive accountholder satisfaction, account longevity, and increased per-account profitability."

"It is critical that banks focus their rewards/loyalty programs on their business banking customers because those customers are five to seven times more profitable than retail customers and with increased product ownership and growing bank balances, these loyal customers are increasingly profitable over time."

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Learn More About This Report & Javelin

Make informed decisions in a digital financial world