Overview

“The benefits of this new hardware and software paradigm will prove as important as the introduction of the computer chip,” said Tim Sloane, VP, Payments Innovation, and author of report. “While adoption in larger merchants may take decades due to the complexity of the payments infrastructure, the path to adoption will clarify as network implementations further mitigate security risks. As security risks are addressed merchants, acquirers, and banks will focus their energies on delivering greater value to consumers through the smartphone.”

This report is 30 pages long and contains 8 exhibits.

Companies mentioned in this report include: Amazon, American Express, Apple, Apriva, Bank of America, Clover, Discover, Estimote, First Data, Google, MasterCard, Microsoft, NCR, PayPal, Samsung, ShopKeep, Softcard, Square, Starbucks, TSYS, Vantiv, Visa, and World Pay.

Members of Mercator Advisory Group's Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

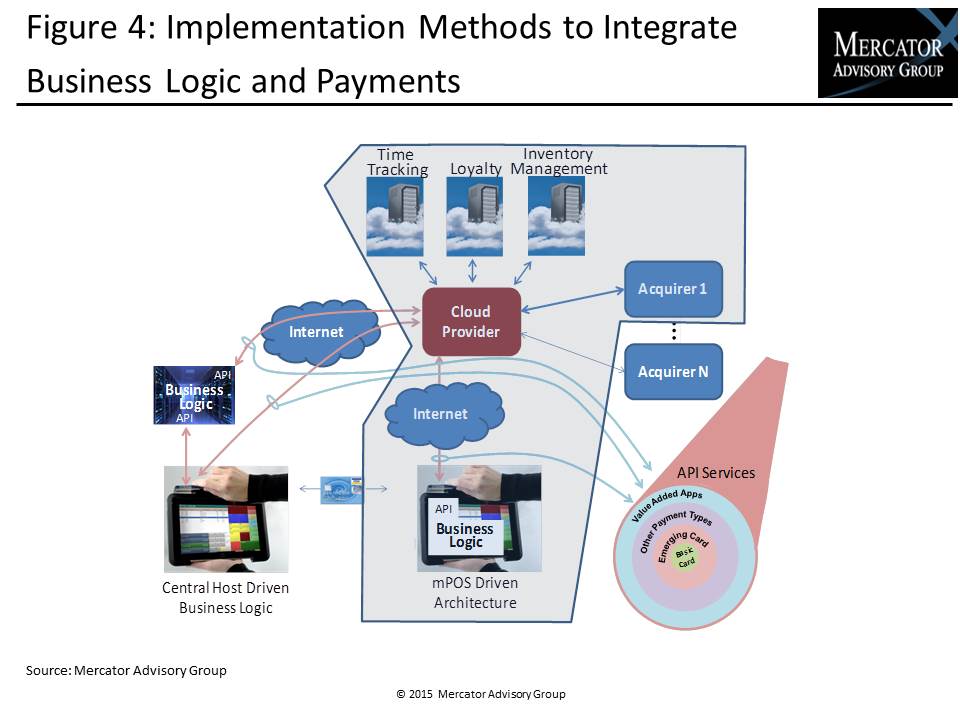

One of the exhibits included in this report:

- An in-depth analysis of mobile-based architecture’s primary design benefits to the consumer, the merchant, and the associated payment processor

- Recommendations for recognizing and avoiding implementations that may limit business model flexibility, restrict application and service options, and thus increase average lifetime cost

- A review of existing implementations in the field that leverage m-POS architecture today

- A review of how identity is managed in payments today and how control over identity credentials has become the future battleground within this new architecture and identity management will ultimately replace enrollment as the primary point of consumer control

- Discussion of technologies and concepts related to M-POS, including Apple iBeacon, Apple iOS, Apple iPad, Apple iPhone, bar codes, Bitcoin, Bluetooth low energy, chip and PIN, cloud computing, check underwriting, digital currencies, EBT cards, EMV, fingerprint recognition, geofencing, gift cards, Google Android Open Source Platform (AOSP), independent software vendors, inventory management, loyalty programs, MCX CurrentC, Microsoft Phone, payroll, PCI compliance, QR codes, recurring payment, Samsung Knox, search by voice, split tender, tokens, Touch ID, virtual cards, voice recognition

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world