Overview

Boston, MA

February 2004

The Market for Corporate Cards

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

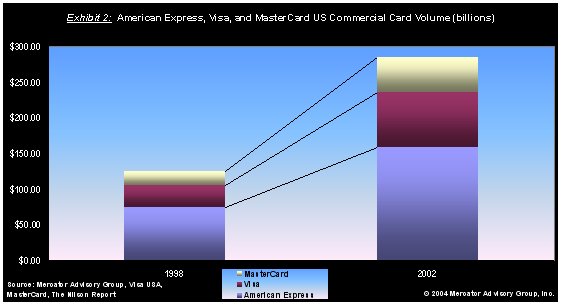

As the consumer credit market matures, issuers and credit card associations are seeking new sources of transaction volume. Commercial card market is one of them. While the consumer credit card charge volume grew at 9.8 percent from 1998 to 2002, commercial card market grew at a 20-30 percent rate. During this period, the commercial card volume growth rates for American Express, and MasterCard/Visa combined were 20 percent and 25.77 percent respectively.

Equipped with information management and e-business tools, commercial card programs offer corproations significant cost reductions in purchasing. And, as a result, their popularity is increasing.

Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service and author of the report comments, "although there have been very significant developments in the way companies conduct business today, we have yet to realize the end-to-end e-business vision. Companies still print out invoices, handle purchasing manually and use cash and checks for payment, especially for large ticket items. Solutions such as Visa Commerce and MasterCard e-P3 are designed to tackle these hurdles and get companies closer to this streamlined vision of the future."

This new Mercator Advisory Group report takes a closer look at this rapidly growing market, focusing on business cards, corporate cards and purchasing cards. It provides definitions, value propositions, market size, and example solutions for each category and highlights recent initiatives in the commercial card arena.

This report contains 31 pages and 16 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world