Overview

Mercator Advisory Group's Seventh Annual Closed-Loop

Prepaid Market Assessment

Boston, MA -- The Closed-Loop prepaid market grew by 7% in 2009, totaling $205.39 billion in dollars loaded onto cards. This market now accounts for more than 62% of all prepaid purchases, while the Open-Loop market, had loads totaling only $124.6 billion in 2009, accounting for 38% of prepaid purchases.

Digital Content, Government and Telecommunications are the three market categories most responsible for driving the increase in Closed-Loop market share , with growth rates of 16%, 19% and 10% respectively. The Digital Content category was driven to a large extent by the Digital Media segment that includes Apple Inc. and other music and video prepaid products. The Government segment was driven by government assistance programs that saw a significant increase in aid disbursement due to a bad economy leading to regrettable fact that more people now meet the assistance program guidelines.

Note, however, that as Mercator Advisory Group predicted, not all Closed-Loop segments saw growth. For instance, dollars loaded onto Closed-Loop cards used for consumer incentives fell 8% from 2008 levels and the Closed-Loop Gift Card market segment continued its slow growth at 3%.

"Mercator Advisory Group has once again found that prepaid is the best payments market to be in during a recession," Tim Sloane, Vice President of Client Services and Director of Mercator Advisory Group's Prepaid Advisory Service and author of the report comments. "Growth continues across most segments of the market and likely will continue whichever way the economy goes."

Mercator has identified the solutions that are poised to kick-start the Closed-Loop gift card market back into high growth mode. While virtual cards and mobile wallets have only just started to penetrate the market Mercator Advisory Group is confident that properly implemented these technologies will enable Closed Loop Gift Cards to compete aggressively with Open Loop cards.

"While virtual cards and mobile wallets are a novelty today, these technologies will be instrumental in driving growth for the closed loop gift market over the next ten years," Sloane says. "Although the impact of these technologies will first be felt in the B2B incentives market where it enables personalized messages combined with instant availability, the technology will ultimately be instrumental in integrating Prepaid Closed Loop programs to consumer loyalty programs."

Highlights of the Report Include:

The total load for all 26 prepaid segments in 2009 (Open & Closed) was $330.03 billion, a $60.74 billion increase over the $269.29 billion load in 2008 an increase of 23%.

There were $205.39 billion loaded onto Closed-Loop prepaid cards in 2009, an increase of 7% over the 2008 load of $191.78.

Closed-Loop Gift Cards used for Consumer Incentives fell by 8% in 2009, to $4.41 billion, a dramatic decline from 2008's increase of 19%.

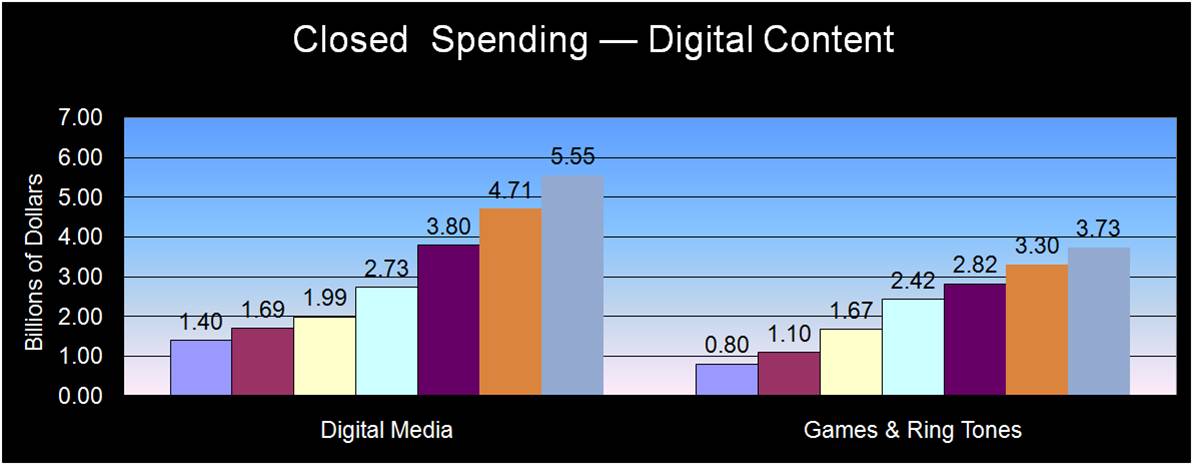

The Digital Content Category had another great year growing to $9.29 billion, for a growth of 16%. Of this Digital Media, driven by Apple and other music prepaid products, accounted for $5.55 billion, for an 18% growth rate, despite a poor 2009 holiday season.

The Gift Card market segment only grew by $2.14 billion, an increase of 3%.

Government nutrition programs had rapid load growth of 19%, to $45.87 billion, driven by a bad economy and more people meeting assistance program guidelines.

One of 13 exhibits in this report.

This report is 27 pages and is accompanied by 13 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Boston, MA - November 30, 2009 -- The projected growth of the Prepaid Market in general, and the solid growth within particular prepaid segments, suggests that the Prepaid Industry will continue to attract new players and investments and will remain extremely dynamic.

Although many segments within both the Open and Closed Loop prepaid card markets have seen lower growth rates in 2008, the fact remains that growth for Network Branded solutions continue to outpace Closed Loop by a significant amount and has proven critical in maintaining a positive overall growth rate for the prepaid market as a whole.

Several significant adjustments have been made to this year's forecast to reflect increased reporting from prepaid processors. Most importantly several Open Loop segments have had future growth rates substantially increased to reflect the actual growth measured in 2008. Based on our adjustments Mercator Advisory Group now predicts that the Open Loop market will exceed the size of the Closed Loop market in 2012 by $41.8 billion.

This greatly anticipated report finds that the total load volume across all 33 Prepaid Market Segments, including all Open and Closed Solutions, will reach $525.8 billion by 2012.

The Prepaid Market Forecast 2009 to 2012 report is the final of three annual Mercator Advisory Group reports that thoroughly benchmark the entire Prepaid Industry. This report provides a growth forecast for all 33 Prepaid Market Segments, including load volumes and cards issued.

The Prepaid Market Forecast 2009 to 2012 report delivers significant data that addresses the comparative growth rates of different segments and the forecasted future growth based on Mercator's exclusive insights and analysis of these segments.

"When the prepaid market is evaluated on a segment-by-segment basis, it becomes clear that there are far more markets that are expanding or thriving in this economy than there are segments experiencing negative growth. Mercator Advisory Group expects this will continue to be the case as the industry moves forward unless legislation is passed that negatively impacts current market conditions," comments Tim Sloane, Director for Mercator Advisory Group's Prepaid Advisory Service.

Highlights of the report include:

- The Open Loop market will exceed the Closed Loop market in total dollars loaded as early as 2012.

- Based on these adjustments, Mercator Advisory Group now predicts that the Open Loop market will exceed the size of the Closed Loop market in 2012 by $41.8 billion.

- Based on other reports that argue the prepaid market is smaller than reported here, Mercator Advisory Group redoubled efforts to collect data from processors and received input from several new sources. With regrets to Federal Reserve Board (FRB) statements to the contrary, every additional data point we received indicates that the open loop market is larger than we have reported, not smaller.

- Due to corrections that increased the size of the Open Loop market, the Total Prepaid Market size in 2011, which was forecast at $362.3 billion last year, is now forecast to be $427.5 billion.

- In 2008, $8.7 billion was loaded onto GPR products and with this forecast we estimate that the market load in 2010 will be $36 billion and continue to escalate out to 2012.

One of the 93 Exhibits included in this report:

- See more at: http://dev.mercatoradvisorygroup.com/Templates/Report.aspx?id=1199#sthash.E1GUnI6r.dpuf

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world