Overview

Boston, MA – December 31, 2013 –Today’s card accepting retailers are trying to manage EMV implementations, mobile payments, data security, rewards/loyalty, surcharging, and emerging payment networks, among other items. Each of these challenges is creating numerous opportunities for acquirers, processors, and independent sales organizations (ISOs) to provide additional products, services, and advice.

Now in its seventh iteration, Mercator Advisory Group’s annual report on the U.S. merchant acquiring market, Merchant Acquiring in 2013: New Distribution Channels Drive Growth discusses market performance of the largest U.S. acquirers as well as emerging issues in the acquiring space.

In particular, this report discusses the importance of solutions for securing card data and managing PCI compliance costs as well as the potential impact of emerging solutions for mobile card acceptance. The report also analyzes several key events and themes worth tracking in 2014 such as EMV implementations, fallout from interchange regulation and merchant discount litigation, PayPal’s in-store rollout, and the growing importance of small and medium enterprises (SMEs) and industry specialization for growing payment volumes.

“The U.S. merchant acquiring market is definitely a growth market,” comments Michael Misasi, senior analyst at Mercator Advisory Group and author of the report. “Acquirers that are both opportunistic with their vertical strategies and flexible with regard to implementing new technologies for emerging payment segments will benefit the most from this growth.”

This report contains 25 pages and 12 exhibits.

Companies mentioned in this report include: American Express, Chase Paymentech, Discover, Diners Club, Elavon, Element Payment Services, First American Payments, First Data, Global Payments, Heartland Payment Systems, JCB, Litle, MasterCard, Moneris, Mercury Payments, NPC, PayPal, TSYS, Vantiv, Visa, WorldPay

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

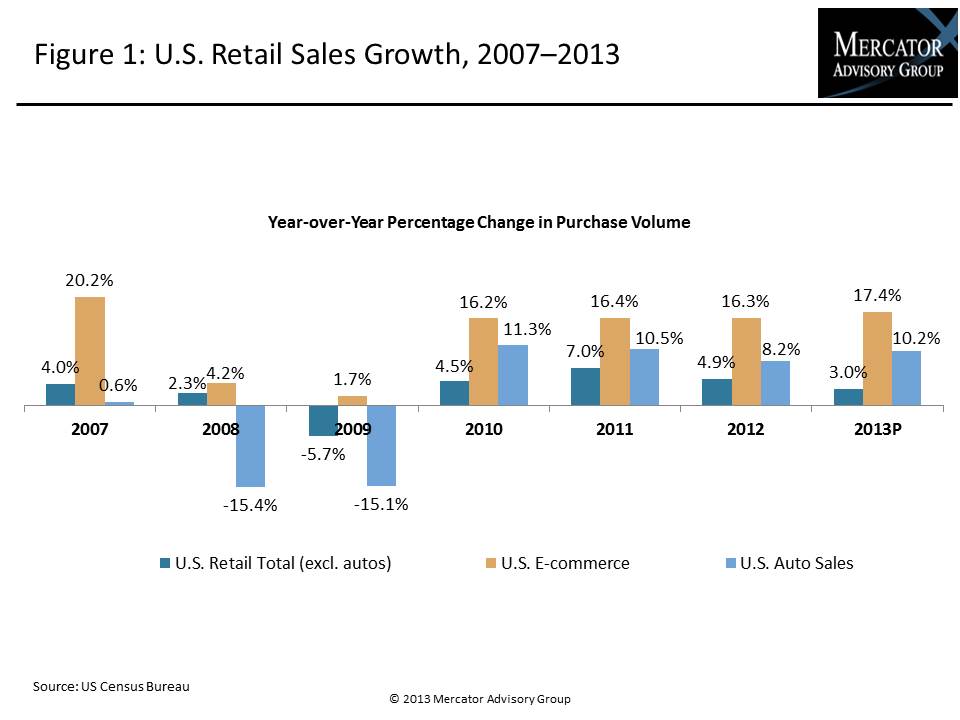

One of the exhibits included in this report:

Highlights of the report include:

- Market share estimates for the largest acquirer processors

- Profiles of the top 8 processors in the U.S., including recent performance and product announcements

- Analysis of how emerging solutions for securing data and providing mobile acceptance are changing the acquiring landscape

- Discussion of 6 key events and themes to track in 2014

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world