Overview

August 2008

Merchant Funded Discount Networks: Adding to the Payments Value Chain

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Merchant Funded Discount Networks (MFDN) provide a cost-efficient consumer loyalty, incentive, or promotional marketing initiative that can use a prepaid card or other payment card as the instrument for targeting customers and delivering offers and incentives. Merchant partners in the discount network enjoy the benefit of new customers garnered from the card portfolio, as well as the much-desired lift in sales that targeted promotions can provide. The card holder enjoys cost savings or support in an aspirational purchase, a new and potentially beneficial merchant relationship, or reinforcement of an existing affinity, and an enhanced customer experience.

The prepaid (or other card) program benefits by increased revenues from several angles: 1) a more attractive value proposition for the cardholder's usage of the card, and thus an increased "sticky factor," 2) an increase in dollar volume produced by increased usage, and therefore more interchange and transaction fee revenues, as well as, 3) in some cases, the difference between the merchant discount payment and the discount offered to the cardholder. In most cases, the Merchant Funded Discount Network manager is an entity separate from the prepaid Program Manager, however Mercator Advisory Group is aware of program managers seeking to wring more profitability out of their prepaid programs that have been designing and implementing their own MFDNs. In this report, we examine the implications associated with bringing this traditionally outsourced function in-house.

The popularity of Merchant Funded Discounts and Rewards among more traditional debit and credit card issuers and other consumer "aggregators" is also growing. Not only are employers, banks, credit and debit card issuers, and even the card networks themselves using Merchant Funded Discounts (MFDs) to fund cardholder rewards or employee incentives, strengthen merchant relationships, and optimize their new account marketing efforts, but prepaid issuers and program managers are implementing or partnering with MFDNs to boost card usage and profitability.

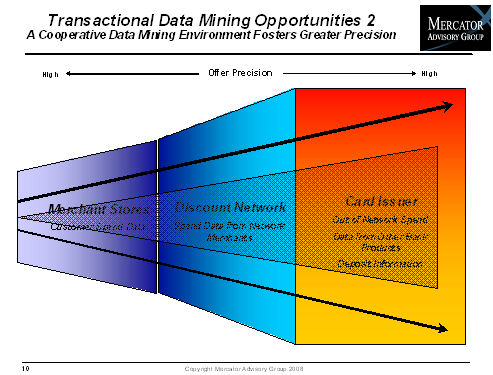

One of the 10 Exhibits included in this report

This report contains 29 pages and 10 exhibits.

Report Highlights:

- Merchant Funded Discount Networks are a relatively new marketing catalyst in the payments space, which is seeking new vehicles for providing a more robust proposition to all value chain participants. Merchant funded rewards are a "must have check-box" on most issuers' card programs.

- Mercator has identified 6 distinct go-to-market models for merchant funded discounts that can be used by participants in the payments space. These segments use distribution channels that can either be direct or indirect to the consumer.

- Existing MFD network managers are increasingly seen as potential acquisition targets as card issuers of all kinds confront the "build, partner, or buy" dilemma. Regardless of the outcome of that argument, more and more card issuers and processors of all kinds (prepaid, debit, and credit) are considering an in-house MFDN.

- As the online channel for MFDs gets saturated, networks supporting discounts to be used in-store at brick and mortar locations will present added value in new implementations.

- For now, the "per drink" transaction fee for the customer purchases delivered to the merchant is the dominating revenue model, but the market may be shifting.

David Fish, Senior Analyst in Mercator Advisory Group's Credit Advisory Service and principal analyst on the report, comments, " a Merchant Funded Discount Network is a revenue-generating value exchange and process flow used in promotional marketing and incentives to establish or enhance benefits perceived by the consumer, whereby a merchant or a group of merchants pays a discount to an intermediary who distributes the discount among all participants in the value chain. Generally speaking, the primary levers that program managers should use for recruiting merchants into the discount network are the cardholder demographics and the consumer spend data resident within the prepaid portfolio. These present the merchant with the information necessary to deliver targeted and tailored incentives, rewards, or discounts to the customers that will be most likely to engage in them."

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to mailto:[email protected]

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world