Overview

Merchant Funded Rewards -Debit Loyalty Programs and Roles for Acquirers in MFDNs

Boston, MA -- Dec. 23, 2009 - Much has been said over the last couple of years regarding the shift in consumer behavior toward usage of debit based payment products, what this shift will do to core payments industry business lines, and how the recession might be accelerating the shift. Equally important is the discussion regarding the impact of this trend on financial services firms' loyalty and rewards initiatives. One of the trends Mercator Advisory Group has noted in our research has been the emerging presence of Merchant Funded Discount Networks (MFDN) in a number of debit issuer's rewards programs.

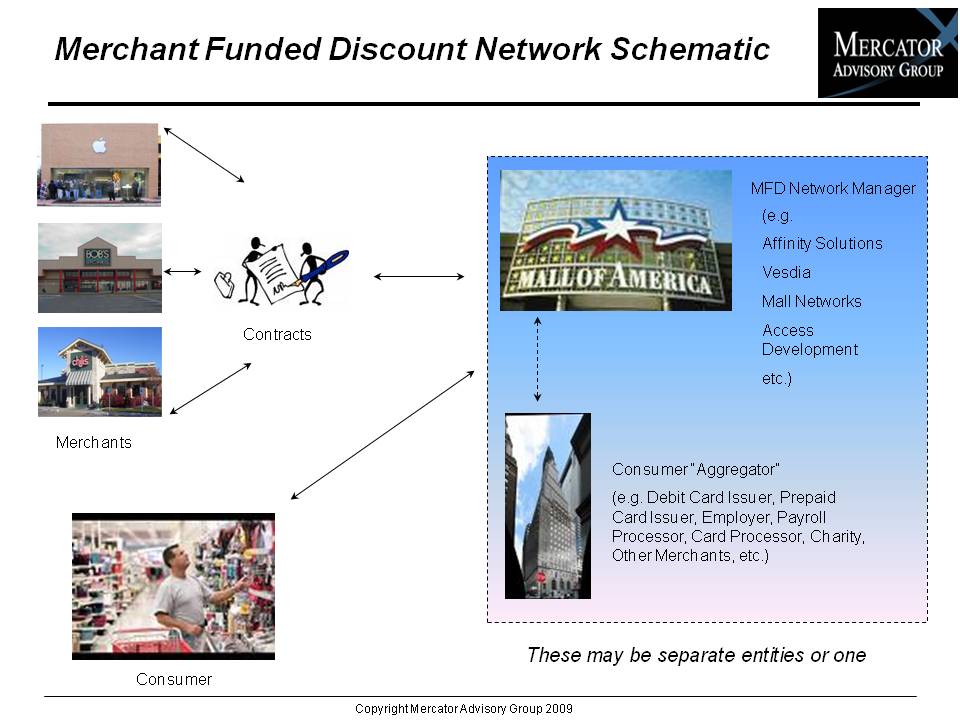

Mercator Advisory Group's Merchant Funded Rewards - Debit Loyalty Programs and Roles for Acquirers in MFDNs report reviews how MFDNs operate and looks at the benefits for each stakeholder in the MFD value chain. We discuss how merchant funded rewards and merchant funded discount networks are impacting existing debit card reward programs, along with a review of some of the strategies that various card issuers and MFDNs have been using recently to enhance the debit card value proposition. Also evaluated are the selected debit card rewards programs that are currently in operation that rely solely on merchant funded discounts or are enhanced by them. We also examine the potential roles that merchant acquirers might play in merchant funded discount networks, from a third-party vendor perspective, from a reseller perspective, and from an owner/operator perspective.

The Acquirer as Participant

Merchant funded discounts are vitally important when considering their potential for dramatically altering the payments and banking industry landscape if they are more broadly adopted. The potential shift becomes apparent when one considers the level of control and participation the merchant receives when they participate in a MFDN, which serves to mitigate, if not eliminate, the problem merchants have with payment card rewards programs (i.e. merchant acquirers pass through larger interchange costs associated with processing transactions on rewards cards). Even though merchants will still pay fees for accepting the cards, these programs offer them the opportunity to steer the payment towards the combination of merchandise and payment form most profitable to them. Therefore, a merchant funded discount strategy pulls the pendulum closer to center in a two-sided interchange system.

"Perhaps the challenge that is first among equals surrounds the economics of delivering a rewards/loyalty program based on debit card transactions. This problem is one that MFDN strategies directly address, offering a clear opportunity for issuers and card reward program managers to refine their loyalty offerings to accommodate the shifting payments mix," David Fish, Senior Analyst in Mercator Advisory Group's Debit Advisory Service comments. "Issuers who enhance their debit reward programs with merchant funded discounts enrich the payments value chain by accessing revenue streams that are supplemental to existing interchange revenue, and, in some cases, may actually offset the majority of the cost of the program."

Highlights of this report include:

Merchant Funded Rewards have been anticipated as the next big thing in debit card programs since they debuted less than a decade ago. They are finally beginning to see some broader adoption.

For relationship banking initiatives, an understanding of the merchant funded discount paradigm could provide a key competitive advantage to FIs' ability to grow and protect their core deposit base.

Much of the value associated with merchant funded rewards lies in the data analytical capabilities of the providers. Those capabilities could be enhanced by engaging with merchant acquirers.

Aquirers also represent potential partners and resellers for MFDNs as they seek to expand their merchant networks.

Liability reserves for traditional rewards programs are at an all-time high, putting additional pressure on the already reduced interchange income available to fund debit rewards programs. Merchant funded programs offer issuers cost savings while maintaining their customer value proposition.

One of 7 exhibits in this report:

This report is 24 pages long and has 7 exhibits.

Companies mentioned in this report include: Access Development; Affinion Group; Affinity Solutions; American Express; AmSouth Bank; Bank of America; Chockstone; Citibank; Comerica Bank; Golden Retriever Systems; Heartland Payment Systems; JPMorgan Chase; Mall Networks; MasterCard; SunTrust; The DataBase Group; TSYS; USAA; Vertrue Inc; Vesdia; Visa; Webloyalty.com; Zions Bank.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world