Overview

Boston, MA

December 2008

Merchant Payment Switching: Saving Money amid the Constraints

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Mercator Advisory Group is pleased to announce the release of its latest report, "Merchant Payment Switching: Saving Money amid the Constraints"

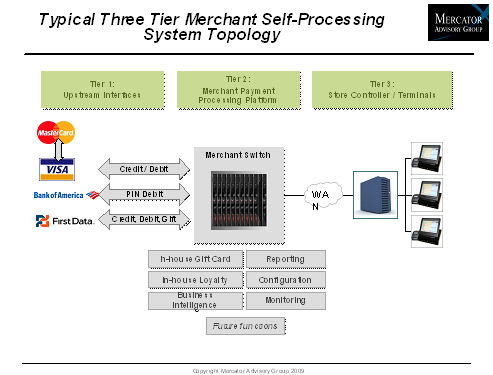

When large merchants take control of payment switching - directly connecting to card networks, debit processors and others, they save substantially on per swipe fees, savings that can add up to millions per year. They also arm themselves with capabilities that range from simplifying POS terminal management to the ability to add alternative payment methods without waiting for upstream processors. Given immediate access to payment metadata, reporting and CRM get more powerful as well.

On the other hand, self-processing brings on a raft of compliance and support issues that were, in the past, completely the province of the traditional processor. The merchant who takes on payment switching brings on more, rather than less, of the PCI compliance burden.

This new report examines the merchant payment switching proposition, evaluates potential costs savings, and reviews the WAN requirements and costs for a large retailer. The report examines the case of one large retailer and briefly profiles seven vendors of switching software and systems.

The report concludes with an examination of the characteristics required by the merchant successfully deploying these solutions and a discussion of how the current economic climate and tightened IT budgets will force vendors to evolve their business models.

Highlights from this report include:

- Payment switching is one tool in a growing box of cost saving and revenue enhancing options that favor merchants, if only they elect to pick them up.

- Large merchants can drop the cost of their payment switching costs by 40% or more depending upon payment volume, payment mix, and cost allocation.

- From a staffing point of view, the self-processing decision runs counter to general outsourcing trends.

- Vendors of self-processing platforms are faced with a difficult selling environment for licensed software and a growing business model transition toward hosted solutions.

- In 2009, the question facing merchant IT organizations will be "what level of investment can we make to save the enterprise money on its payment processing cost?"

- Switching platforms provide flexibility for future payment-related programs but who is buying "futures" today?

"For high volume merchants, taking on switching makes great financial sense. But given the economic downdraft, the long planning to deployment timeframe and merchant IT inclinations, it has to be challenging for vendors to move this up in the retailer's priority queue," comments George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "As switching becomes more readily available on hosted platforms and more integration points are developed, volume will shift to these vendors to take advantage of lower costs. Down the line, the softer benefits will become more compelling."

Companies mentioned in this report include ACI Worldwide, Postilion, JCB, ISD Corporation, Kabira, Alaric, Distra, First Data, TSYS, Casey's, Sheetz, Euronet, Telecash, Corner Banca, Aduno, Swisscard, Yorkshire Building Society, Cumberland Building Society, Ukash, VocaLink Limited, Woolworths, Canadian Tire, Retalix, Visa, MasterCard, Microsoft, Oracle, and IBM.

One of the 5 Figures included in this report:

The report is 29 pages long and contains 5 exhibits.

Other recent reports from the Mercator Emerging Technologies Advisory Service:

| Driving Consumers Toward Mobile Money Services: Lessons from South Africa, the Philippines, and Kenya | |||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world