Overview

The ubiquity of Internet-connected mobile devices is reshaping the preferences and expectations of consumers when it comes to acquiring products and services—in every industry. The financial services industry is no exception. Banks, credit unions, and other financial institutions (FIs) are already starting to see decreases in account opening through traditional channels like the branch and online as mobile-focused customer acquisition strategies have begun to take off.

Despite clear shifts in consumer preferences and behaviors, a majority of financial institutions do not currently allow their customers to select, apply for, and open new financial accounts entirely on a mobile device. There are a myriad of legal, technical, and institutional barriers standing in the way. None of these barriers is insurmountable, but collectively they represent a steep challenge for FIs to overcome.

Mercator Advisory Group’s research report, Mobile Account Opening: Adjusting to a New Normal, reviews the trends driving consumer demand for and FIs’ interest in mobile account opening (MAO) and outlines the challenges and potential solutions for enabling MAO for different financial products and customer use cases.

“Today, the mobile channel contributes a small trickle of new accounts for most banks. Within a few years, it will be a flood,” comments Alex Johnson, Director, Credit Advisory Service at Mercator Advisory Group and the author of the research report. “Changing consumer behaviors suggest an important role for mobile account opening moving forward, the question is when and how financial institutions should respond.”

This research report contains 39 pages and 18 exhibits.

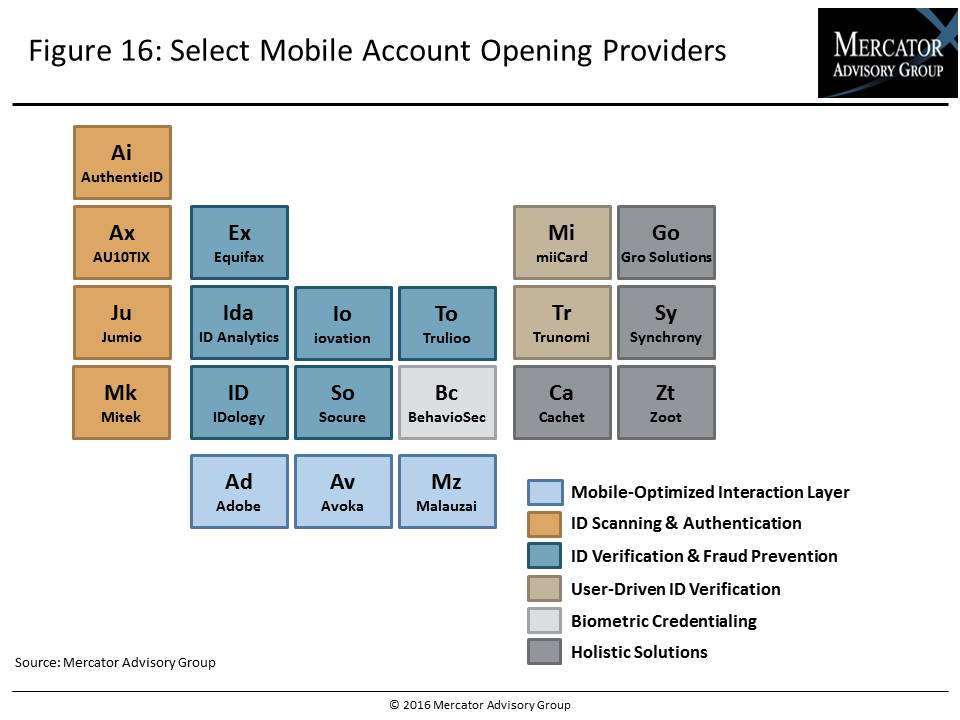

Companies mentioned in this research note include: Adobe, Amazon, AU10TIX, AuthenticID, Avoka, BankMobile, BehavioSec, Betterment, Cachet Financial Solutions, CreditCards.com, Credit Karma, Equifax, Experian, Google, Gro Solutions, ID Analytics, IDology, iovation, Jumio, Lending Club, Malauzai, miiCard, Mitek, MorphoTrust USA, OnDeck Capital, Payfone, Salesforce, Socure, SoFi, Synchrony, Trunomi, Trulioo, USAA, Yodlee, and Zoot.

One of the exhibits included in this report:

Highlights of the research report include:

- A review of the trends and technologies reshaping consumers’ commerce behaviors and expectations

- An overview of the “buyer’s journey” for financial products and the impact that digital technologies have had on it

- Discussion of the challenges that financial institutions face in developing and deploying mobile account opening for customers

- Recommendations for financial institutions on redesigning the account opening process to fit on smartphones and tablets, with specific guidance on identifying and supporting different use cases

- Review of some of the leading mobile account opening solutions available in the market

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world