Overview

New research from Mercator Advisory Group examines

mobile payment opportunities for U.S. credit issuers

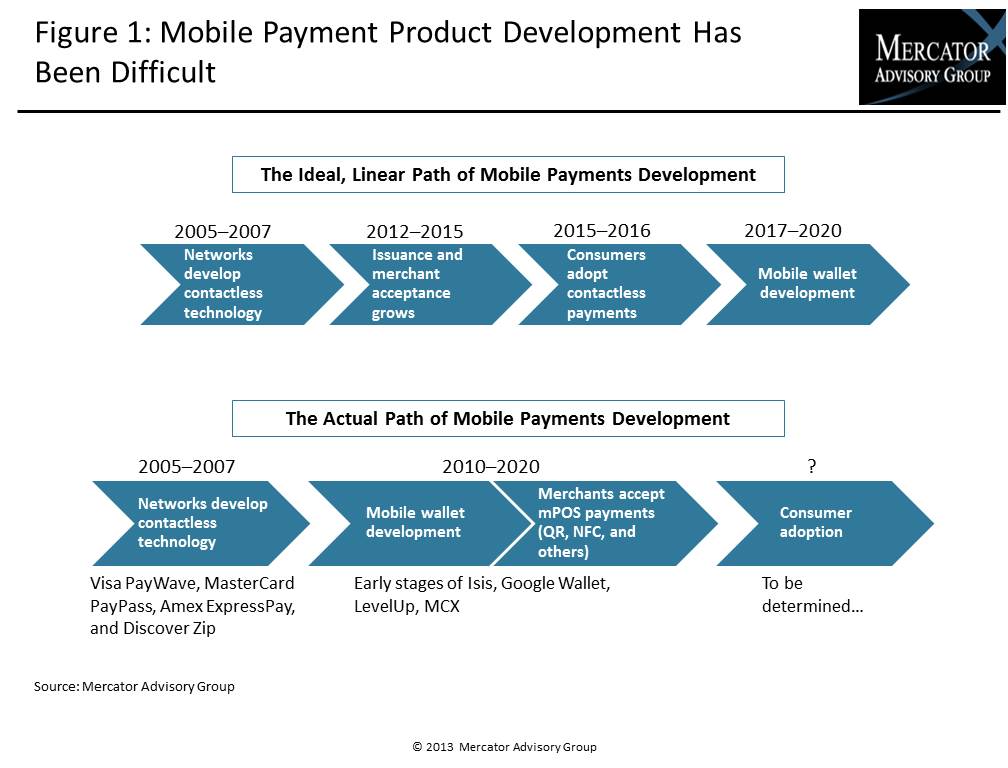

Boston, MA - July 30, 2013 - The major card networks began supporting contactless payments nearly a decade ago, but consumer and merchant adoption has lagged considerably. Several startups, as well as established firms outside of the financial services industry, are marketing enhanced mobile payment services capable of causing significant disruption to the consumer payments value chain.

Mobile operating system developers, handset manufacturers, and mobile network operators are among the first to market with mobile wallets, but traditional IT suppliers to financial institutions are starting to develop solutions to help banks respond. The largest U.S. credit card issuers are investing, piloting, or otherwise exploring several mobile payment options to make sure they can quickly implement the technology that is most widely adopted. Mercator Advisory Group's most recent research report, Mobile Payments: Opportunities and Strategies for Credit Issuers, provides a framework for understanding the current and potential impact of mobile payments technology on the credit issuing business.

"Tech companies are challenging issuers' core business at a time when competition among existing industry participants is extremely high," comments Michael Misasi, senior analyst at Mercator Advisory Group and author of the report."Issuers are rightly protective of their transaction data and cardholder relationships. Fortunately, financial institutions have several strategic assets that can minimize the threat of disruption."

This report contains 24 pages and 7 exhibits.

Companies mentioned in this report include: AT&T, Bank of America, Citibank, Device Fidelity, FIS, Fiserv, Gemalto, Google, HTC, ISIS, JPMorgan Chase, LG, MasterCard, MCX, Paydiant, U.S. Bank, Samsung, Sprint, Starbucks, T-Mobile, Vantiv, Verizon, Visa, Wells Fargo,

Members of Mercator Advisory Group's Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of the report include:

- Mercator Advisory Group's latest statistics on consumer adoption of various mobile payment technologies

- A credit issuer-centric SWOT analysis of the mobile payments industry

- An overview of the most prominent mobile wallet providers including ISIS, Google Wallet, Starbucks, and MCX

- A prediction of how the next round of mobile wallet products is likely to operate

Learn More About This Report & Javelin

Related content

2025 Credit Payments Trends

In 2025, credit card issuers are not just facing change; they are at the forefront of shaping the future of the consumer credit industry. Despite the weakening consumer economics, ...

2024 Mass-Market Credit Cards Scorecard

Mass-market credit cards must balance features and rates to attract average U.S. consumers. This Javelin Strategy & Research report benchmarks general-purpose credit cards by 10 ma...

Market-Driven, Risk-Based Credit Card Pricing Works: Price Controls Would Disrupt Borrowing and Lending

A 10% cap on credit card interest rates—an idea floated in the presidential race—would have profound effects on the credit card market, cutting deeply into how credit cards are pri...

Make informed decisions in a digital financial world