Overview

Mobile Point-of-Sale Solutions: A Comparative Analysis

New research from Mercator Advisory Group evaluates cost-saving

mobile card-acceptance solutions for merchants

Boston, MA -- As mobile devices continue to develop, their potential to influence the payments industry steadily increases. This potential is perhaps most evident in the solutions on the market that enable a merchant to use a smartphone or tablet to replace a traditional point-of-sale (POS) terminal or system for accepting card payments. These systems range from simple dongle-based systems to complex wraparound “sleds” for mobile devices that are less expensive than a traditional POS system but have more capability. From top to bottom, these solutions are revolutionizing the way merchants accept payments.

Mercator Advisory Group’s new report, Mobile Point-of-Sale Solutions: A Comparative Analysis, evaluates 16 different mobile point-of-sale (mPOS) solutions, including simple mobile card acceptance solutions, more advanced mobile registers, cutting-edge enterprise mPOS solutions, and alternative mPOS solutions that use a mobile device to execute a transaction in ways that were impossible with traditional systems. The solutions are assigned scores in five different categories: potential future impact, technical innovation, infrastructure evolution, consumer benefit, and merchant benefit. These scores enable direct comparisons between solutions.

Highlights of the report include:

In-depth profiles and analyses of 16 mPOS solutions from 12 different vendors, focusing on competitive differentiators and the ability of each solution to continue providing value over the next few years

Scores for each solution enabling direct comparisons, as well as the rubrics used to generate them

Explanation of which mPOS solutions provide the most value for both merchants and consumers, both now and in the near term future

“While mPOS was originally designed to be an inexpensive and simple option for card acceptance, with some investment it can also provide features well beyond the capabilities of traditional POS devices,” says Dave Kaminsky, analyst in Mercator Advisory Group’s Emerging Technologies Service and author of the report. “In the near future, mPOS will be at the forefront of POS technology employed at every level, from street vendors to national retailers.”

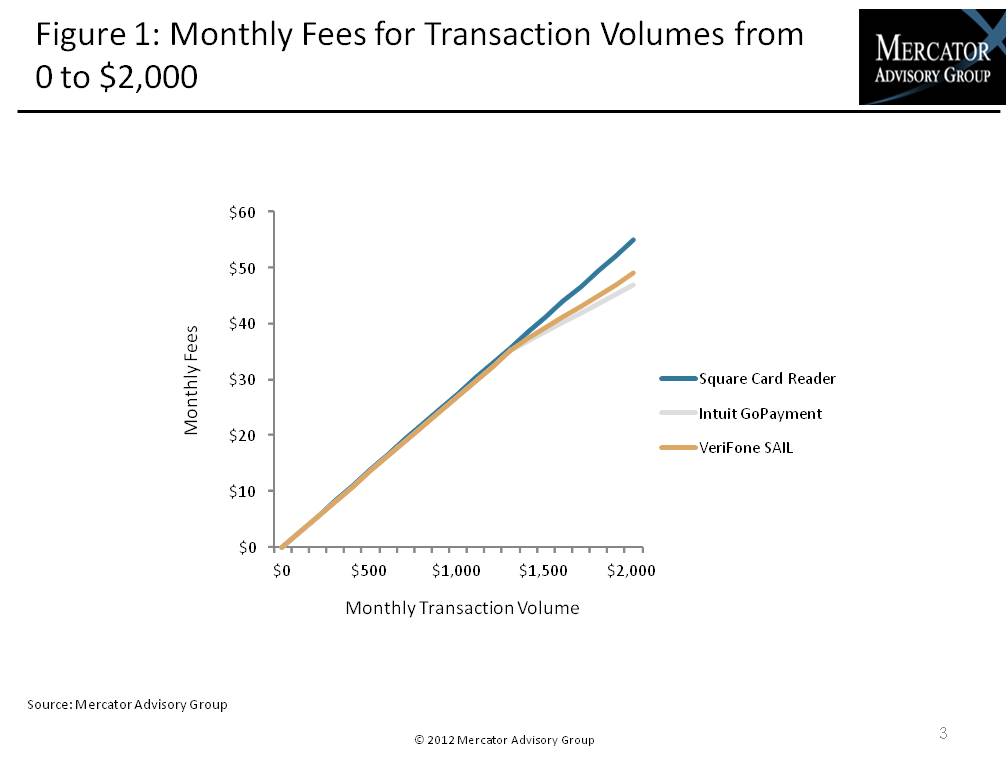

One of the eight exhibits in this report:

This report is 35 pages long with eight exhibits.

Companies mentioned in the report include: Square, PayPal, iZettle, Intuit, Roam Data, NCR, PayAnywhere, GoPago, Ingenico, VeriFone, LevelUp, Tabbedout, Visa, MasterCard, American Express, Discover, and Diners Club.

Members of Mercator Advisory Group’s Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected]

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world