Overview

This research from Mercator Advisory Group provides an analysis of the Consumer Financial Protection Bureau’s proposed prepaid rule, now in its comment period. The provisions of the nearly 900-page rule seek to increase consumer protections for users of open-loop prepaid cards of all types.

Mercator Advisory Group’s research report, titled Murphy’s Law and the CFPB: The Proposed Prepaid Rule Won’t Protect Anyone, identifies several areas of concern for prepaid providers and cardholders. Because of the breadth and depth of the prepaid regulations, the report highlights certain provisions likely to cause confusion or have other negative consequences, including unintended consequences that ultimately would harm consumers by making a convenient financial tool less available and making the surviving products more confusing. The intention of this report is to give prepaid providers starting points for their own analysis of how the rules might affect their cardholders and businesses.

This report encourages providers of prepaid cards, and their partners and cardholders, to comment on the rules by the March 23 deadline. It suggests strategies for crafting comments, and offers suggestions in the text on how the rules should be adjusted.

"While the rule contains good ideas that could benefit providers and card shoppers, there are several provisions that would actually reduce consumer protections," comments Ben Jackson, director of Mercator Advisory Group's Prepaid Advisory Service, and author of the report.

This report has 19 pages and 3 exhibits.

Members of Mercator Advisory Group's Prepaid Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

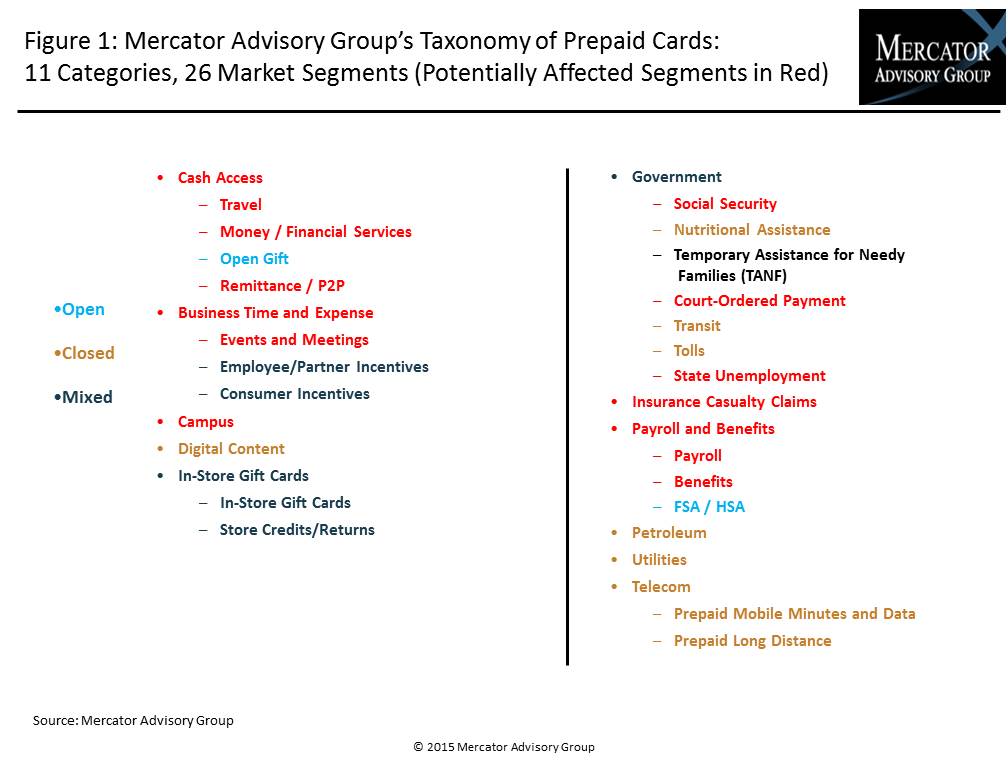

One of the exhibits included in this report:

Highlights of the report include:

- The Consumer Financial Protection Bureau (CFPB) has released a proposed prepaid rule two years after an advance notice of rulemaking and has asked the payments industry to respond in 90 days.

- The 869-page rule is nearly three times as long as the rules that implemented Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act and is loaded with unintended consequences.

- The rule would lead to less access and more confusion for prepaid customers, thus harming the consumers it is designed to protect.

- The rule also would pull new types of payments companies under the prepaid umbrella and lead to further confusion and frustration among consumers.

- Prepaid providers should comment on the rules to address how individual provisions will harm their cardholders and propose alternative rules.

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world