Overview

Boston, MA

September 2007

Non-Prime Issuing Opportunities: Setting Multiple Bars for Diverse Segments

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the opportunities and tools available to credit card issuers and a few alternative lenders in the very broad non-prime consumer market. What emerges is a picture of an expanding frontier, with:

- subprime prospects well-covered by established decisioning and data tools

- thin credit bureau file prospects becoming increasingly well covered by established alternative data sources and scoring tools

- "no file" prospects remaining on the frontier of specialized, sometimes narrow data sources, specialized analytics, and alternative card products.

Competitively, the reasons for pursuing non-prime segments are readily apparent. Subprime consumers, while possessing a high risk of default, will likely bear a higher range of risk-based pricing (ARPs, fees) in order to gain access to credit, and skilled issuers can manage the portfolios to a higher overall return. Thin file or no-file consumers have less of a demonstrated credit track record, and may prove to be either good or bad credit risks. While some of these thin-file/no-file individuals can appropriately be called credit-underserved (i.e. they collectively represent a backlog of prospects who deserve credit consideration), these segments contain perennial new prospects as well: students, first time credit users, immigrants, etc...

Highlights of the report include:

- None-prime consumers, defined by multiple segments delimited by bureau score ranges or lack of bureau files, represent 80 - 105 million credit prospects.

- Subprime credit card prospects, defined by a demonstrated history of credit problems, are so far avoiding the drastic declines of subprime mortgage holders.

- Thin file credit underwriting tools are rapidly maturing, with an ability to handle previously-unscorable individuals.

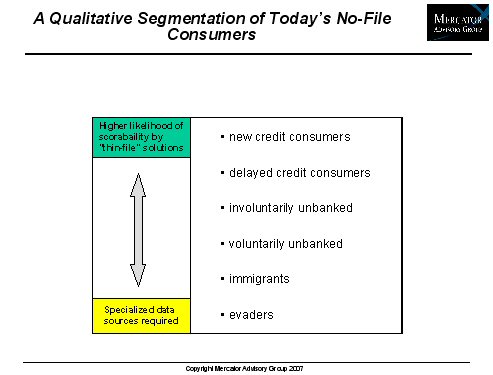

- Remaining unscorable prospects with no bureau files reside on the frontier of underwriting tools. Specialized data sources and analytics are the tools of lenders wishing to address these remaining no-file prospects.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report comments that, "clearly credit card issuing in the non-prime segments is a tough business - but so is issuing to prime customers with mail response rates below 1%. At least there are new and underserved prospects in the non-prime pool. The challenges are identifying their risk profiles and matching them with appropriate pricing and monitoring parameters."

One of the 8 Exhibits included in this report:

The report is 30 pages long and contains 11 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world