Overview

Online Banking Today and Strategies for the Future:

Increasing Adoption, Access, and Usage

Boston, MA - Mercator Advisory Group today released the Online Banking Today and Strategies for the Future: Increasing Adoption, Access, and Usage, research report, which analyzes the current state of online banking and identifies the strategies banks need to execute to expand adoption and increase usage of this low cost channel.

This report recommends that banks adopt a more aggressive strategy that will give them a competitive advantage with internet savvy and younger consumers who will fuel banks profits in the decade ahead.

Online Banking Today and Strategies for the Future: Increasing Adoption, Access, and Usage, surveys the top 30 U.S. full-service retail bank websites and identifies the appropriate level of adoption of four key initiatives that the report recommends. The report also details the current level of internet access, online banking adoption and customer satisfaction with the online banking experience.

Highlights of this report include:

Internet access now stands at 74 percent and limits the universe of customers who can sign up for online banking. It's only a mater of time before the younger cohorts that have integrated the internet into their day to day life become an important customer segment and drive online banking adoption higher.

Banks have been investing heavily in the online experience and have dramatically increased their online customer satisfaction scores over the past ten years. Banks now out perform online retailers once considered the gold standard for quality online experiences.

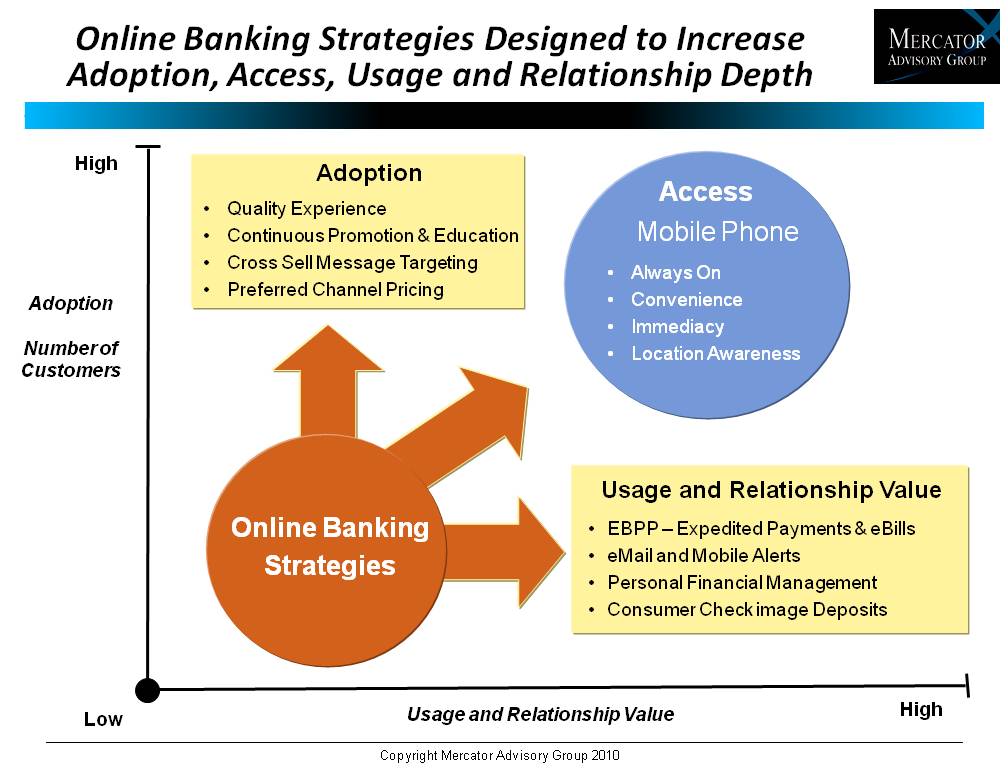

Banks are executing a number of initiatives that are increasing online banking adoption, access, usage and relationship depth. Continuing to promote online banking capabilities at every opportunity is essential for success and when successful online banking creates additional "impressions" that enhance brand and cross selling effectiveness.

Mobile banking is an essential ingredient to an online banking strategy and broadens access, increases usage and provides a platform for innovative products and services in the future.

Banks need to expand the capability of their online banking solutions to increase usage and deepen the customer relationships. In addition to offering mobile banking, banks need to expand their EBPP capabilities with eBills, provide easy to use "lite" personal financial management solutions and add consumer check image capture to capabilities.

"Online banking has continued to gain adoption over the past decade and will eventually out rank branch location in the list of decision criteria when a consumer chooses a bank." states Bob Landry Vice President Mercator Advisory Group's Banking Advisory Service. "While the promise is clear, banks must continue to promote online banking to increase adoption, expand access with mobile banking and increase usage by adding new capabilities. Those banks that continue to execute an aggressive online banking strategy will not only reduce costs, they will also be the choice of the next generation of consumers who have integrated the internet into their lifestyle. They will naturally gravitate to the banks that meet them where they work and play - online."

One of the 21 exhibits in this report:

There are 35 pages and 21 exhibits in this report.

Companies mentioned in this report include: Amazon, LL Bean, Barnes & Noble, Adobe, Bank of America, Fiserv, Harris Bank, Intuit, JP Morgan Chase, KeyBank, PNC, SunTrust, USAA FSB, Wells Fargo.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected].

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Make informed decisions in a digital financial world