Overview

Online Debit: Selling Convenience (And Trust)

Report Examines Online Payments Opportunity and Risk for

Debit Card Issuers

Boston, MA -- In new research, Online Debit: Selling Convenience (And Trust), Mercator reviews the range of consumer online payment activity through the filters of new technologies, merchant focus on product expansion, and the role trust and security play at the point of purchase.

The electronic payments evolution that's driving investments into mobile wallets and NFC-enabled devices is also placing added pressure on the debit card programs of traditional retail financial institutions. Everyday purchases, long the core base of debit card transactions, are being enabled online by merchants offering an increasing number of consumable items (such as groceries) with all the shipping and purchasing conveniences consumers expect in the online experience.

Merchants are tying together online and offline buying experiences through web and mobile-enabled application to enable convenient "one-click" buying experiences. At the same time, merchants can incentivize consumers to pick one payment form over another through discounts and other promotional programs.

Highlights of this report include:

The role of signature and alternative debit forms in online payments.

An overview of new online debit technologies being introduced in the market.

Profiles of consumer demographics most likely to drive increased online spend within everyday item categories.

An analysis of the potential impact of merchant's expansion into grocery, pharmacy, and other daily commodity categories to the debit market, as well as their influence over payment types.

A discussion regarding the importance of issuers building an expanded view of how consumers use their depository accounts to protect and grow their retail banking franchises.

A review of the impact of risk management for issuers and consumer' concerns about protecting their cash accounts on online debit payments.

"Consumers' ability to access the Internet through an ever wider variety of untethered devices makes the ability to transact at will a de facto requirement for more and more transactions. Our research indicates that everyday spend transactions, those lying at the heart of the debit market, are being enabled online or through online/offline combinations by most of the largest retailers in the United States.," Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service comments.

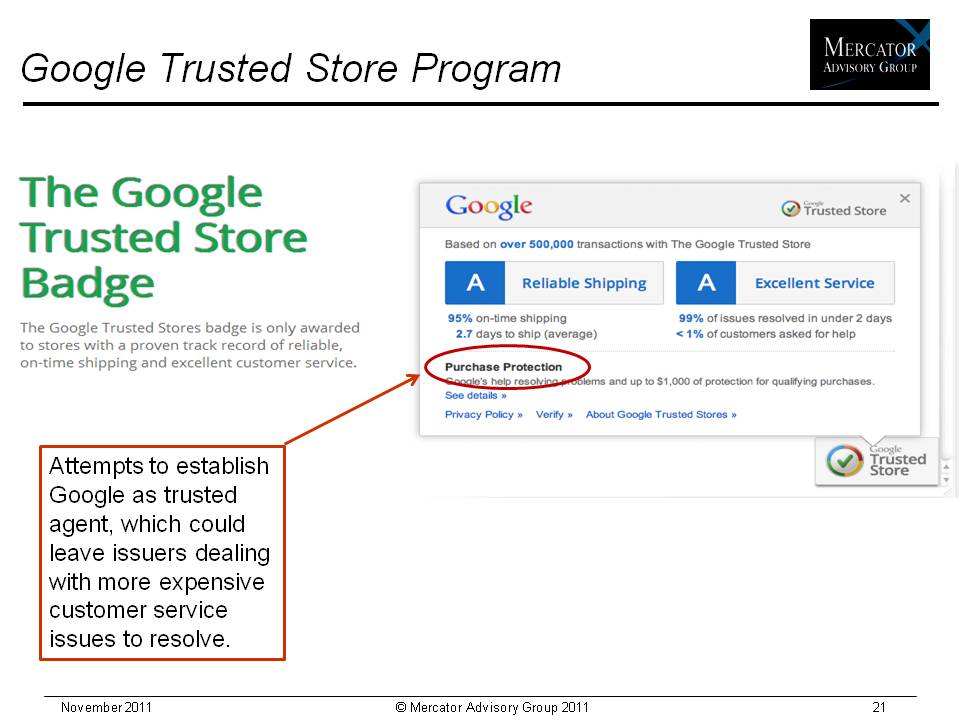

One of 21 exhibits in this report:

This report is 32 pages long and has 21 exhibits.

Companies mentioned in this report include: Amazon, Acculynk, Adaptive Payments, WalMart, Cardinal Commerce, Google, PayPal, CVS, American Airlines, Authorize.net, NACHA, MasterCard, and PreCash.

Members of Mercator Advisory Group's Debit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world