Overview

Boston, MA

December 2008

Open-Loop Retail Reload Networks: Drivers of Increased Retention or Agents of Churn?

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Although cardholders of reloadable network branded solutions have the ability to reload their prepaid cards at the point-of-sale (POS) today, the various arrangements with the reload networks results in cardholders receiving a multitude of service experiences and impedes the sustained usage of general purpose reloadable products.

Reload networks, still in their early infancy, represent the next stage of development for prepaid and offer an opportunity to reduce high churn rates currently experienced by many GPR products. The reload networks as they operate today, in a fragmented manner with pricing that does not support low dollar loads, may be prompting churn and as a result challenging the growth of GPR products.

The networks either support specific card types and brands and/or offer financial services and products that compete directly with their membership. Due to an overwhelming focus by the industry to serve the unbanked and underserved, Mercator Advisory Group predicts that there will be increased challenges within the retail channel for continued implementation of reload.

Mercator Advisory Group estimates that close to 50% of the current prepaid market would enable reload at retail locations. Specifically, Mercator Advisory Group estimates that the dollar value opportunity for reloads at retail is roughly $100.5 billion opportunity. Of this total opportunity open-loop solutions represent less than 10% of this total opportunity at $9.7 billion. The opportunity for closed-loop reloading is $90.8 billion which dwarfs that of open-loop reloads by ten times.

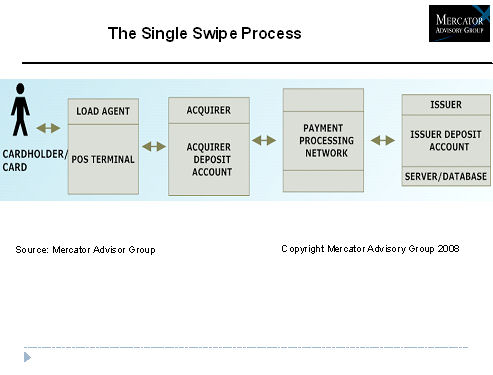

Discussed in this report are the attributes and strategies of today's leading reload networks supporting open-loop solutions in retail environments and insights into the complex atmosphere in which these networks operate and the challenges they face and pose. This study also provides Mercator's definition of a reload network, an overview of the success factors needed to operate a reload network including a discussion on pricing, an overview of the two options in today's market for reloading open-loop cards at the POS - the single step or swipe method and/or the two-step method, a snapshot of the regulatory environment surrounding reload and profiles of the three leading networks and their competitors in the retail space.

Brent Watters, Senior Analyst of Mercator Advisory Group's Prepaid Advisory Service and principal analyst on the report, comments, "Green Dot, for years has and continues to hold a commanding lead as the dominant, and for some time the only broadly recognized, retail reload network for open-loop solutions. MasterCard and Visa within the last two years have entered the market with their own reload networks, in some cases riding on top of existing POSA/reload networks, and there are a handful of other reload enables and networks at work in this market. It is clear that the industry views reloading in the retail environment as an important aspect to the future growth of open-loop solutions although it is less clear how the industry can develop the ubiquitous reload solution that is generally understood to be the base requirement for broad consumer adoption."

Highlights from this report include:

- Mercator Advisory Group estimates that close to 50% of the current prepaid market would enable reloaded at retail locations. Specifically, Mercator Advisory Group estimates that the dollar value opportunity for reloads at retail is roughly $100.5 billion opportunity. Of this total open-loop solutions represent less than 10% of this total opportunity at $9.7 billion. The opportunity for closed-loop is $90.8 billion, which dwarfs that of open loop reloads by ten times.

- Reload networks today offer a multitude of service experiences that challenge cardholders and the growth of GPR products.

- The cooperative environment around reload today compromises issuers and will become problematic as existing networks begin jockeying for position within the retail channel.

- The market evolution for reload is in part stymied by the relatively small market opportunity associated with reloading existing GPR products.

- At the POS, cardholders of open-loop solutions are being presented primarily with two options, the single-step or swipe method and/or the two-step method. The major difference between the two is the amount of effort needed by cardholders to conduct a load.

One of the 7 Exhibits included in this report

This report contains 35 pages and 7 exhibits.

Other recently published prepaid reports are:

| 5th Annual Network Branded Prepaid Market Assessment | |||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world