Overview

Boston, MA

June 2007

Mercator Advisory Group

Payments Industry M&A Report - Q1 2007

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

First quarter 2007 M&A activity increased slightly from the Q4 pace to 37 M&A transactions. Venture Capital financing deals dropped from 12 to 4 in the payments industry during the same period.

"Activity in the vendor community slowed yet again during the first quarter of the year", comments George Peabody, Director, Mercator Advisory Group. "But that activity was offset somewhat by increased activity among processors looking to merge operations, acquire wider footprints or expand their service offerings in prepaid and beyond. Venture Capital activity dropped sharply, however this is likely a temporary condition."

There were 37 M&A transactions and 4 Venture Capital financing deals in the payments industry during the first quarter of 2007. During Q1, Vendor M&A activity dropped from the prior quarter by 16%. VC activity cooled considerably.

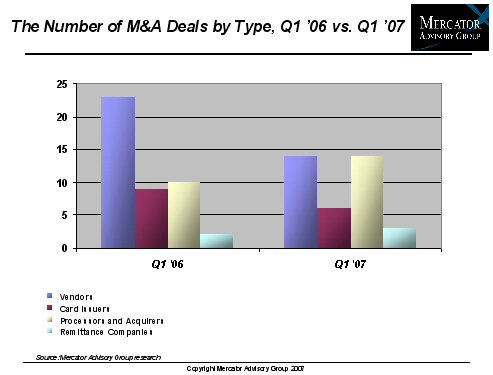

The breakdown of the 37 deals announced in the first quarter is as follows:

* Vendors - 14 deals

* Card Issuers - 6 deals

* Processors and Acquirers - 14 deals

* Remittance Companies and Check Cashers - 3 deals

The Payments Industry M&A Report - Q1 2007 assembles into a single resource a summary of M&A and VC activity along with information on each of the payments industry related M&A deals, contact person(s) related to each deal, and an M&A activity table that summarizes the highlights of the quarter.

This report contains 108 pages, 2 exhibits, and 6 tables.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Make informed decisions in a digital financial world