Overview

Credit card issuers’ interest in mass affluent and high-net-worth cardholders has not waned in the wake of the recession. Indeed, leading premium card issuers have redoubled their efforts to acquire these consumers as a source of high-volume, low-risk credit card spend.

Mercator Advisory Group's report, Premium Credit Cards: How to Hit a Small, Moving Target, updates key statistics on affluent and high-net-worth consumers. It analyzes statistics that are fundamental to card product development in the U.S. market such as market growth, product ownership, and monthly and yearly card spending by cardholder segment. The report also reviews recent developments in the major card networks’ product platforms and provides an update on new features and benefits of leading issuers’ superpremium offerings.

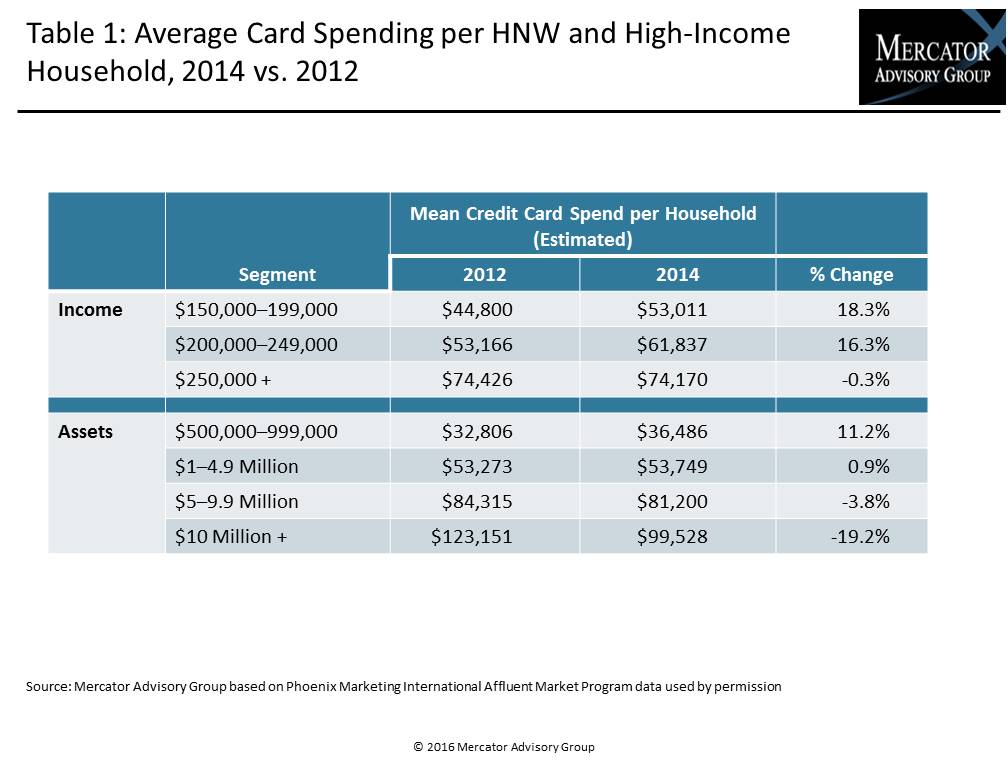

“Growth in the overall number of high-net-worth and mass affluent households has remained modest,” comments Alex Johnson, Director of Mercator Advisory Group’s Credit Advisory Service and author of the report. “The biggest area of growth, in terms of card spend, is occurring in the lowest tier of the mass affluent segment, and this is motivating issuers to invest in the features and rewards of cards targeted at that segment.”

This report contains 27 pages and 14 exhibits.

Companies mentioned in this report include: American Express, Citibank, City National Bank, Discover, Facebook, JPMorgan Chase, MasterCard, and Visa.

One of the exhibits included in this report:

Highlights of the report include:

- Estimates, trends, and penetration rates in premium credit card spending

- Tactics that leading issuers have employed to differentiate premium card brands and products

- An overview of premium product platforms offered at the network level

- Comparison grids of the features/benefits of the most popular premium card offerings

- Strategic considerations for premium card issuers

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world