Overview

Prepaid Card Fraud and Risk Controls in the United States

New research from Mercator Advisory Group examines fraud risk and best practice

for fraud prevention in prepaid card programs

Boston, MA – November 14, 2013 The new research report titled Prepaid Card Fraud and Risk Controls in the United States examines common ways in which criminals attempt to commit fraud, money laundering, and other types of crime against prepaid programs and what the industry can do about it.

The first section of the report uses recently reported example of fraud and government statistics to reveal the size and shape of the prepaid fraud problem. It also shows why crimes that involve prepaid cards are not due to fundamental flaws with the product type itself. Rather, criminals attack credit cards, debit cards, prepaid cards, and any other financial instrument in which they see weaknesses.

The second section of the report examines the regulatory responses to fraud. Every new instance of criminal activity brings calls for additional regulation of the prepaid industry. The report shows where new regulations have been written and explains why regulating prepaid is not always the best response to crime.

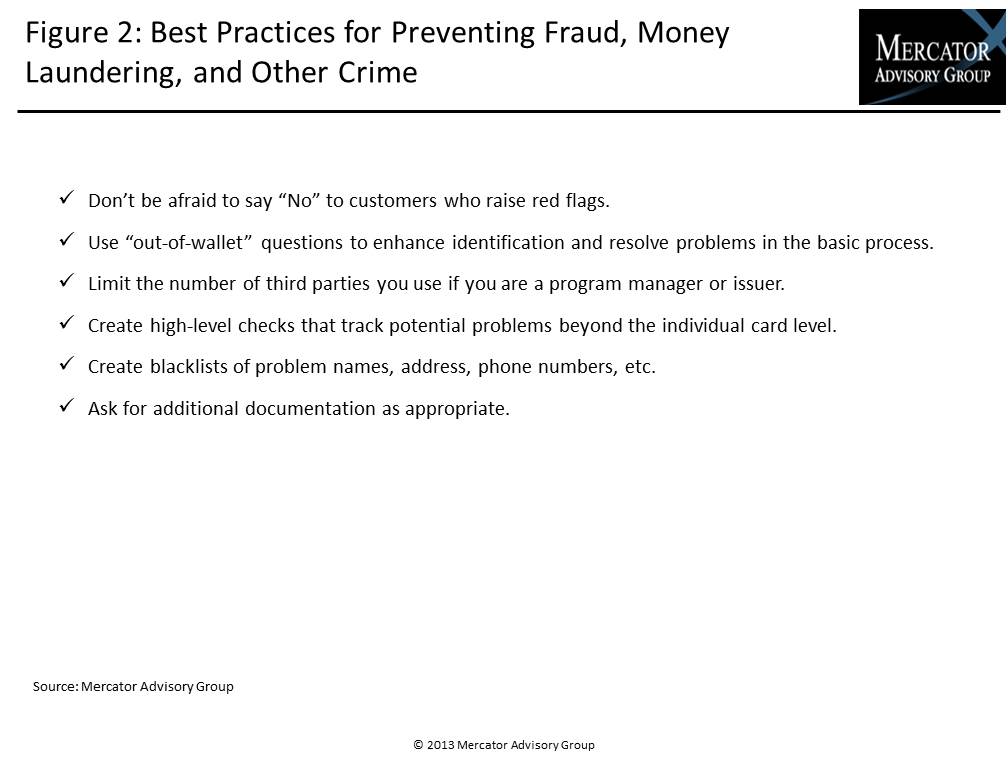

The third section of the report examines best practices for combating prepaid card fraud and other types. The report discusses preventive measures that can be taken throughout the prepaid value chain to deter criminals.

Additionally, the report contains suggestions for reading and describes how several processors help manage fraud risks for issuers and program managers.

"Prepaid fraud is a serious, but manageable problem, as long as all the members of the prepaid value chain work together. There is nothing inherent to prepaid that makes it more or less risky than other financial products," comments Ben Jackson, senior analyst of Mercator Advisory Group's Prepaid Advisory Service, and coauthor of the report.

One of the exhibits included in this report:

- Fraud, money laundering and other criminal activities plague prepaid card providers, but the problem is not inherent to the payment type.

- The size of open-loop prepaid fraud is relatively small when compared with debit fraud, but it remains an important issue.

- Prepaid fraud and criminal activity can be divided into fraudulent funding, fraudulent usage, and money laundering/criminal activity.

- Banking regulators have extended their examination scope to prevent criminal activity on prepaid.

- Best practices exist that can make prepaid fraud a manageable problem, but providers must continually work to stay ahead of the criminals.

Learn More About This Report & Javelin

Related content

Payments in the Arena: Prepaid Can Move Into the Starting Lineup as Cash Gets Cut

Sports and entertainment thrive on fan loyalty but have yet to translate that dedication into long-term, connected share of wallet once fans are inside the turnstiles. Prepaid stor...

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

Make informed decisions in a digital financial world