Prepare for the Regulatory Trend Focused on Fairness and Clarity in Financial Services

- Date:October 05, 2016

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Mercator Advisory Group’s latest research note, Prepare for the Regulatory Trend Focused on Fairness and Clarity in Financial Services, discusses the need for a new business model in the credit card industry that responds to the new regulatory trend exemplified by recent actions of the U.S. Consumer Financial Protection Bureau by bringing together a focused management infrastructure with stronger analytics, more focused investigating staff, and a well thought out mission for education, fairness, and transparency.

Financial indications to the card industry can be seen in the Return on Assets metric, which fell steadily between 2013 and 2015; Mercator Advisory Group expects the decline to continue as card issuers conform to new standards. A long-term concern of the issuers is that an economic downturn might bring excessive risk to the credit card industry and entirely negate profits, as happened during the recent recession. In 2009, the U.S. credit card market, the largest and most established card market in the world, produced net losses for most top issuers. The new credit card business model requires issuers to be more effective in their credit policies and fraud controls as well as to create better efficiencies on their operating expense lines.

“It is hard to complain about regulatory burdens when the CFPB keeps bringing up valid business issues that center on integrity,” comments Brian Riley, Director, Credit Advisory Services at Mercator Advisory Group, the author of the research note. He adds: “Credit card issuers must look at the risk and revenue metrics in good times and bad, and make real business decisions about whether they are willing to accept the margins that will come from tighter control.”

This document contains 10 pages and 6 exhibits.

Companies mentioned in this research note include: American Express, Capital One, Chase, Citi, Discover First National Bank of Omaha, and Wells Fargo Bank NA.

One of the exhibits included in this report:

- Discussion on the regulatory shift to now cover consumer fairness and clarity

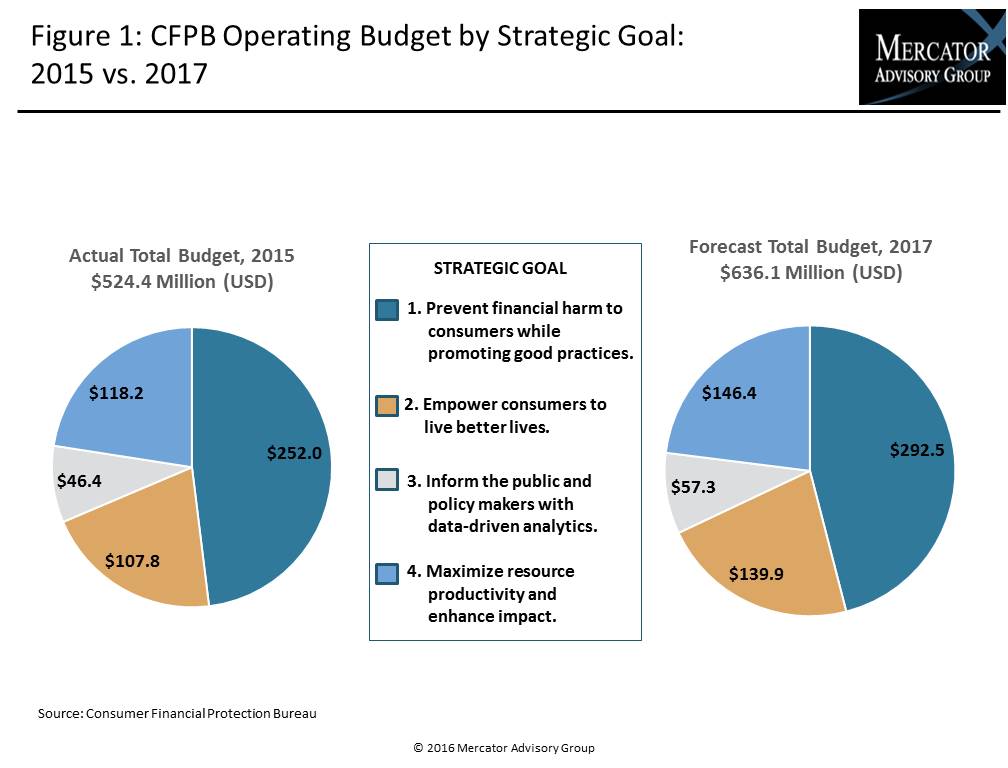

- Operating budget and staffing configuration for the Consumer Finance Protection Bureau

- Summary of recent CFPB actions

- Strategic opportunities for card networks and credit card issuers

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world