Processing Recurring and Subscription Payments Without Friction: A Key to Unlocking Transactions from a Forecasted $830 Billion Card Market

- Date:February 23, 2022

- Author(s):

- Ben Danner

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Subscription and Recurring Payments Is a Large Market with Lots of Opportunity

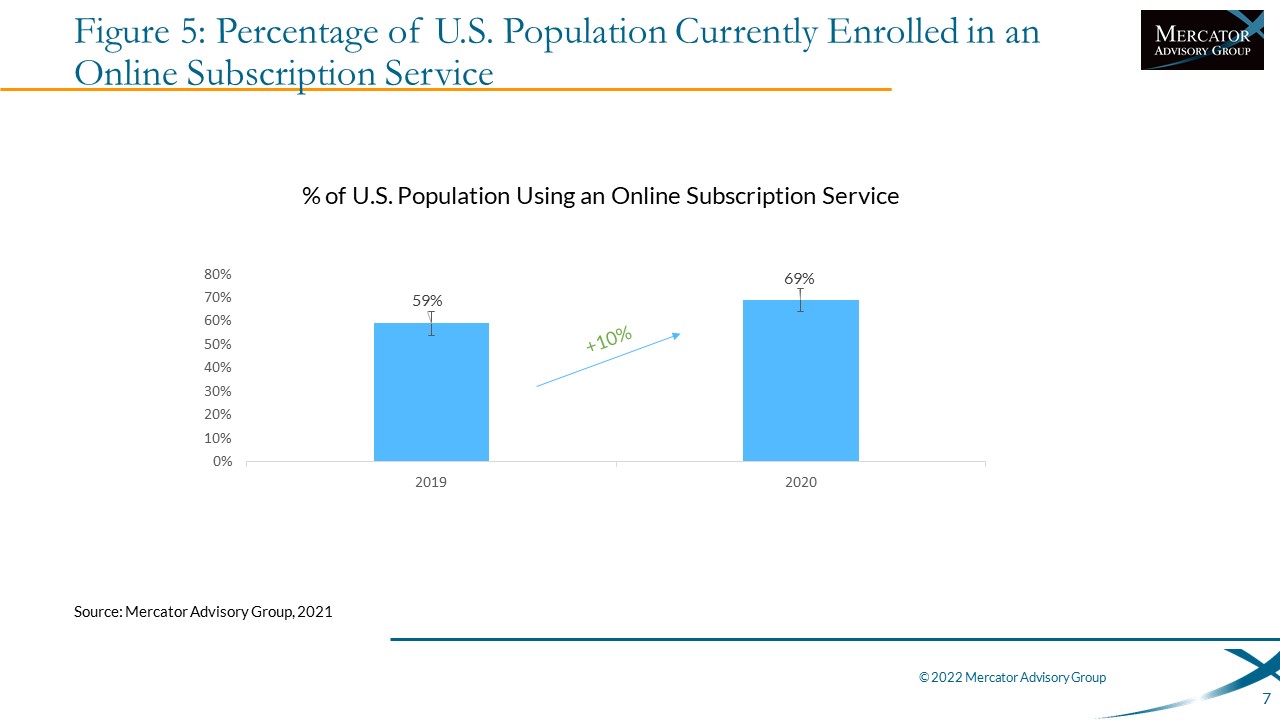

Recurring payments is a high-growth market in the U.S. and is expected to generate $830 billion in transaction volume by 2025. In this report, we define recurring payments and analyze the U.S.

consumer market for various recurring payment types, with a particular emphasis on the subscription marketplace. Merchants need to find ways to optimize solutions for common payments

issues with chargebacks and involuntary cardholder churn. Issuers need to be paying attention to the developments in the subscription app marketplace. Furthermore, this research explores last year’s regulatory changes to recurring payments in India.

“Reducing friction is the key to customer generation and retention,” comments Ben Danner, Analyst, at Mercator Advisory Group, and the author of the research report. There are a number of opportunities that exist to develop and refine the recurring payments economy.

This report is 24 pages long and contains 11 exhibits.

Companies and Apps mentioned in this report include: Consumer Financial Protection Bureau (CFPB) ; Truebill, Hiatus, Billbot, BillGO, Bobby, Subby, Mint, First Performance, Chargebee, Recurly, Cash App, Netflix, Apple, Reserve Bank of India, Spotify, Visa, Mastercard, Subscribed Institute, GoCardless, American Express, Amazon, AT&T, Audible, CBS, Disney, ESPN, Fubo TV, HBO, Hulu, iHeartRadio, Luminary, MLB.TV, NBA League, NHL.TV, Pandora, Showtime, Sling TV, SiriusXM, Stitcher, YouTube, Vudu, Headspace, Inc., Verizon, US Bank, Wells Fargo, Prism, Mollie.

One of the exhibits included in this document:

Highlights of this document include:

- Recurring payments market analysis and forecasting

- Payment methods used for subscriptions services

- How subscriptions effect credit cards and rewards

- Optimizing churn rate, payments failures, and chargebacks

- Personal finance apps and the subscription marketplace

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world